We WON’T Do Without!

Global Survey of Millennials Hint at Big Changes for Networks

The massive generation of Millennials is only a few short years away from becoming the primary market for wireless operators, broadband providers, and enterprise data centers. The implications for the modern network are profound:

• Ages 15-35, Millennials are now more than 2.5 billion strong — the largest living generation.1

• In 2015, Millennials surpassed Baby Boomers as the largest US voting-age population2 with $2.45 trillion in global spending power.3

• 86% of Millennials live in emerging markets like Brazil, China, and India.4

• By 2018, the number of Millennials will overtake the number of Baby Boomers in the US workplace.5

• By 2025, Millennials will comprise 75% of the global workforce and more than $8 trillion in disposable income.6

Millennials, those born between 1981 and 2000, are quickly becoming a financial juggernaut. In stark counterpoint to the aging Baby Boomer generation, they have firmly asserted their influence as the emerging (and soon, dominant) demographic for consumer spending in every major industry. Technologically fearless, cost-conscious, Internet-empowered, strongly opinionated, and hungry for transparent communication — theirs is a truly mobile lifestyle.

This ultra-tech-savvy generation views reliable, ubiquitous Internet access as a given — so much so that they prioritize connectivity over nearly every other basic utility, and express a significantly higher willingness to pay for fast, flexible, scalable service based on individual lifestyle needs, network reliability, and service quality.

The technology and connectivity expectations of Millennials present game-changing financial opportunities for providers agile enough to understand how best to monetize networks in support of their lifestyle.

Reconfiguring the Social Lifestyle

It is important to note that Millennials (especially younger Millennials — those under 20) are the first generation who find it difficult to remember life without the Internet. This point cannot be overstated: younger Millennials are the first cohort to grow up within a fully immersed digital, wireless world. Rather than treating the Internet as a "tool", a "knowledgebase" or a "means to an end" — views more likely held by Gen Xers or Baby Boomers — younger Millennials view the Internet as an indistinguishable part of their individual identity. It is the social fabric of their lives, and is viewed much like air or water. (See Figure 1.)

Figure 1. Who can survive one day without it?

Millennials have preferences and spending habits that directly impact telecommunications service providers and content providers. For example, more than 85% of Millennials have smartphones, and more than three-quarters (77%) of Millennials agreed or strongly agreed that they expect to be able to stream video wherever they are. Millennials are willing to pay for higher levels of service; for example, half of Millennials said they would pay 5% of their annual salary for super-fast Internet.

Other key findings include:

• Millennials are so accustomed to the Internet that they would rather give up plumbing, heating and air conditioning, personal transportation, and cable TV before they would go without connectivity and the electricity needed to power their devices.

• Two-thirds of Millennials agreed or strongly agreed that social media is their major form of social communication, compared with one-third of Baby Boomers.

• Three-quarters of Millennials said they would like to adjust the speed of their Internet services depending on their activities — and pay accordingly.

Not Their Grandpa’s Utilities

Perhaps even more surprising than the social media preferences of Boomers versus Millennials were the diverging opinions of each generation in relation to which utilities they considered essential. When asked to select 3 of the following comforts they "could not go without" (electricity, connectivity/Internet access, heating/air conditioning, plumbing, Wi-Fi, a car, cable TV, a landline phone, smoking or alcohol), technology preferences rose to the top of each generation’s list.

Millennials, in particular, are so accustomed to a lifestyle predicated on Internet-based social interaction that their top 3 selections all reinforce a desire to protect that flexibility and easy accessibility. Looking at the conspicuous absence of certain utilities, consider that Millennials would rather go without plumbing, heating and air conditioning, personal transportation, and cable TV before they forego connectivity and the electricity needed to power their connected devices. (See Figure 2.)

Figure 2. Millennials versus Baby Boomers’ utility preferences.

While this may seem shocking at first glance, it is a mirror reflection of how much more time Millennials spend engaged in digital communication compared with other utilities. This order of priorities remains consistent with similar trends in urban development, the automotive industry and the delivery of entertainment programming.

The overall prevalence and impact of anywhere connectivity is also evidenced by the choices of surveyed Baby Boomers, whose first 2 priorities mirrored those of Millennials, albeit at lower percentages (44% vs. 56%).

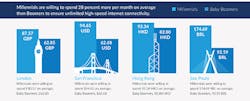

Whether they consume on stunning 4k TVs or small, hand-held devices, the million-dollar question remains: how much of their disposable income are Millennials willing to invest in fast, convenient, reliable connectivity? Compared with Baby Boomers, our survey found surprisingly strong evidence of a markedly greater willingness on the part of Millennials to invest more in their Internet service experience — provided it is far more personalized, flexible, and scalable than any current offerings. Consider 2 of the survey’s more insightful statistics shown in Figure 3.

Figure 3. Millennials’ spending preferences.

As such, global network operators should plan for continued capacity growth, greater flexibility, a larger array of services, and corresponding billing models, to address societal changes brought on by the Millennial generation.

These findings, and others, point to several key imperatives for network service providers:

• Wireless service providers need to continue to build out and expand their networks, while enterprises, retailers, hotels, and other organizations would be wise to work with the providers to address their in-building wireless needs.

• Wireless networks must continue to increase in speed and capacity, and need additional focus on response time (or latency). Advances and adoption of Cloud RAN, Virtualization, and eventually 5G technologies, will likely assist in this mission.

• Fiber will be driven deeper toward the edge to satiate demands for higher bandwidth and improve latency.

• Software-defined networking (SDN) and network functions virtualization (NFV) will improve efficiency, drive capacity where it is needed, when it is needed, and generally increase network agility.

• Providers must proactively adapt business models to provide fast, flexible, reliable, high-quality on-demand service. More bandwidth is a vital part of any network monetization strategy focused on Millennial customers, but a complete solution requires far more depth and breadth. Moving content to the edge will prove an invaluable differentiator in overall service quality, especially since 67% of Millennials surveyed responded that social media

is their primary form of social communication.

Millennials don’t much care about the technical details of the network technology enabling them to experience ultra-fast anywhere connectivity. What they do care deeply about is the quality, reliability, and flexibility of that service. And they care deeply about it right now. The advantage of a converged wired and wireless network architecture will likely give network providers — many of whom are expanding by acquiring content providers — the freedom and flexibility to affordably tailor a wide variety of services to their Millennial customers.

Endnotes

1. Generation Next — Millennials Primer; Bank of America Merrill Lynch; July 2015

2. Millennials; Bloomberg View; December 2015

3. How trillion-dollar millennials are spending their cash; CNBC; August 2015

4. How trillion-dollar millennials are spending their cash; CNBC; August 2015

5. Big demands and high expectations; The Deloitte Millennial Survey; January 2014

6. Big demands and high expectations; The Deloitte Millennial Survey; January 2014

This article is an edited excerpt from the CommScope Millennial Survey Report 2016, Your network: now serving Millennials. Commscope surveyed 4,000 Millennials and Baby Boomers in San Francisco, London, Sao Paolo, and Hong Kong in 2016. Download the full report at http://www.commscope.com/millennials/.

About the Author