The Transition From 4G to 5G —

LTE and its advanced evolutions, deployed on 624 commercial networks worldwide at year end 2018, is

expected to be the dominant mobile wireless technology well into the next decade. 5G Americas published

Wireless Technology Evolution: Transition from 4G to 5G, which details the extensive standards work by the global organization 3GPP in the development of 5G wireless technology.

5G Americas expects that 4 national US carriers will launch 5G networks by the end of the third quarter of 2019, building on the foundation of their global leadership in LTE technology. The association also believes that the US could be well-positioned to continue in a leadership role if appropriate regulatory policies, at the local, state, and federal levels, are in place and adequate spectrum resources are allocated in low, mid, and high bands.

That’s critical since it’s expected that mobile technologies and services will reach $4.6 trillion or 5% of GDP in the US by 2022 (CTIA, May 2017). And while that’s good news in many ways, it’s a bit of both a blessing and a curse. All the data shows mobile consumption increasing, yet US operators are struggling to monetize that trend in an intensely competitive market. In the US wireless market, 2018 started with a service revenue decline — which is similar to the last 3 years. Even mobile data service revenues dipped below the 0% growth market for only the second time in history.

In response, a growing number of operators are focusing on convergence of multiple products and services into a variety of bundled services packages and by partnering with value-added IP-based communications and content providers to achieve improved revenues. Other growth opportunities include the shift to the Internet of Things (IoT) and connected cars for new additions into the ecosystem.

The Upside

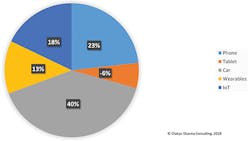

According to Chetan Sharma Consulting, connected cars and IoT continue to dominate the net-adds in the US as shown in Figure 1. Their share of the net-adds reached historic highs in 2018. In fact, the combined category commanded well over 90% share for the first time. The non-phone category went from 39% in 2014 to 71% in 2016. In 2017, the non-phone category again dominated with connected vehicles leading the field for the first time in history. The trend continued in 2018 with the emergence of Connected Wearables as a new category.

Figure 1. US Net-Add Device Distribution — 9 months at 3Q 2018

The phenomenal growth in smarter end-user devices and M2M connections is a clear indicator of the growth of IoT, which is bringing together people, processes, data, and things to make networked connections more relevant and valuable. M2M connections — such as home and office security and automation, smart metering and utilities, maintenance, building automation, automotive, healthcare and consumer electronics, and more — are being used across a broad spectrum of industries, as well as in the consumer segment. As real-time information monitoring helps companies deploy new video-based security systems, while also helping hospitals and healthcare professionals remotely monitor the progress of their patients, bandwidth intensive M2M connections are becoming more prevalent.

Global Growth Continues

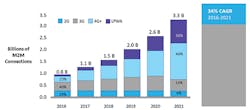

Globally, M2M connections are forecasted to grow from 780 million in 2016 to 3.3 billion by 2021, a 34% CAGR — a fourfold growth (Cisco VNI, February 2017). M2M capabilities, similar to end-user mobile devices, are experiencing an evolution from 2G to 3G and 4G and higher technologies. (See Figure 2.) Currently, wearables are included within the M2M forecast. Global shipments of wearables are due to increase at a 24.8% CAGR over the next 5 years, reaching 162.9 million units in 2020.

Figure 2. Global Machine-to-Machine Growth and Migration from 2G to 3G and 4G+ (Cisco VNI, February 2017)

These devices come in various shapes and forms, ranging from smart watches, smart glasses, heads-up displays (HUDs), health and fitness trackers, health monitors, wearable scanners and navigation devices, smart clothing, etc. These advances are being combined with fashion to match personal styles, especially in the consumer electronics segment, along with network improvements and the growth of applications including location-based services, virtual reality (VR), and augmented reality (AR).

Applications such as VR are also adding to the adoption of wearables such as headsets. VR headsets are going to grow from 18 million in 2016 to nearly 100 million by 2021, a fivefold growth. More than half of these will be connected to smartphones by 2021 (Berg Insight, May 2018). The remaining VR headsets will be connected to PCs, consoles, and a few will be standalone. The wearables category will have a tangible impact on mobile traffic, because even without embedded cellular connectivity wearables can connect to mobile networks through smartphones. With high bandwidth applications such as VR taking off the traffic impact might become even greater.

A great deal of information and research has been dedicated to the IoT and M2M as the approaching Massive IoT (MIoT) provides tremendous opportunities for growth. 3GPP standards in Releases 13 and beyond address these opportunities with Narrowband IoT (NB-IoT) and LTE-M. According to Telegeography’s IoT deployment list, there were 39 global deployments of NB-IoT and 20 deployments of LTE-M as of December 2018.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022While there were 400 million IoT devices using cellular connections at the end of 2016, that number is projected to reach 1.5 billion in 2022 (Ericsson, June 2017). What’s more, it is expected that 70% of the wide-area IoT devices will use cellular technology in 2022 (Ericsson, June 2017). This growth is due to increased industry focus and 3GPP standardization of cellular IoT technologies.

The Devil Is In Mobile Data Speed Needs

A trend revealed by OpenSignal noted that as mobile data speeds increase, users are spending large amounts of time with mobile devices connected to WiFi networks. For instance, South Korea mobile users spend 50% of their time connected to WiFi and in Norway (another country with very fast LTE speeds) it’s 55%. This suggests that mobile access is being used to supplement WiFi networks rather than to replace them.

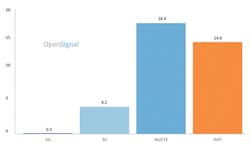

Figure 3 compares the average global download connection speed of the major wireless network technologies. 2G includes GSM and CDMA 1X connections; while 3G includes UMTS, HSPA and CDMA EV-DO connections; 4G is LTE technologies only.

Figure 3. Average Global Download Connection Speed by Technology (OpenSignal, November 2017)

Gigabit LTE has many enabling technologies including key technical options such as 4×4 MIMO, 256 QAM, three-carrier aggregation, and Licensed-Assisted Access (LTE in unlicensed technology). Several leading operators have firmly committed to Gigabit LTE.

For example, in the case of T-Mobile, the carrier said that it had expanded LTE-Advanced to more than 920 markets as of October 2018, and that the principal technologies of 4×4 MIMO, 256 QAM and three-carrier aggregation were enabled in 430 markets in the same timeframe.

AT&T branded their Gigabit LTE network as "5G Evolution" due to its important step into the future network.

Also, as of October of 2018, Sprint began deploying Massive MIMO technology in multiple cities including New York, Los Angeles, and Dallas.

Furthermore, with the combination of LTE aggregated in licensed and unlicensed spectrum, Gigabit LTE deployments and coverage are set to grow substantially. With the introduction of Licensed-Assisted Access (LAA) which is the deployment of LTE in unlicensed spectrum aggregated with LTE in licensed spectrum, more than 90% of operators can roll out Gigabit LTE using just one band of 10 MHz licensed spectrum. This is a powerful option for operators with limited spectrum assets, particularly in markets where the combination of small cells and fiber means unlicensed spectrum needn’t have a compromise on throughput.

Most US operators have embraced LAA in their network deployments. T-Mobile plans to keenly roll out

LAA in combination with small cells, contracting deployment of 31,000 small cells that were in deployment in October 2018. This will play a big part in spreading the availability of Gigabit LTE. Both operators and consumers stand to benefit; as the number of supporting devices increases, network capacity and efficiency are boosted for

all users.

According to Geoff Blaber, analyst at CCS Insight, "Despite the name, Gigabit LTE really isn’t about gigabit speeds. It’s about improving average throughput, increasing network efficiency, reducing congestion and enhancing the experience for all network’s users. With the rise of LTE in Unlicensed (LTE-U) and LAA, we predict that momentum for Gigabit LTE will continue globally over the coming 2 years, as the industry paves the way for 5G. Furthermore, the LTE road map has at least 2 more generations before we get to 5G."

Gigabit LTE is crucial as an underlying technology that will offer the coverage layer for 5G (and the control and signaling for the first launches of non-standalone 5G), and a reminder of why operators are committed to network investment and development.

Could There Be a Better Reason?

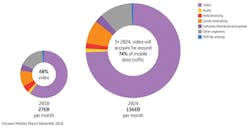

By 2023, more than 30 billion connected devices are forecast; 20 billion will be related to the IoT (Ericsson, November 2017). Connected devices include connected cars, machines, meters, sensors, point-of-sale terminals, consumer electronics, and wearables. (See Figure 4.) Between 2017 and 2023, connected IoT devices are expected to increase at a CAGR of 19%, driven by new use cases and affordability (Ericsson, November 2017). Mobile data traffic will grow from 27 exabytes to 136 exabytes per month between 2018 and 2024 with video claiming 74% of the traffic.

Figure 4. Mobile Data Traffic by Application Category per Month

Therefore, service providers, vendors and stakeholders alike must attend to the progression of standards work done by the global organization 3GPP in the development of 5G wireless technology. The white paper takes a step-by-step look behind the curtain at the 3GPP standards for 5G through Release 16, providing an easy and time-efficient approach to understanding the technology standards development.

Resources

The 3rd Generation Partnership Project (3GPP), http://www.3gpp.org

Berg Insight, http://berginsight.com

CCS Insight, https://www.ccsinsight.com

Chetan Sharma Consulting, http://www.chetansharma.com

Cisco VNI, https://www.cisco.com/c/en/us/solutions/service-provider/visual-networking-index-vni/index.html

CTIA™, https://www.ctia.org

Ericsson, https://www.ericsson.com

LTE and LTE-Advanced Deployments, Telegeography, http://www.5gamericas.org/index.php?cID=161

OpenSignal, https://opensignal.com

Telegeography’s IoT deployment list, http://www.5gamericas.org/files/4115/4645/5381/LTE-Advanced_Pro_definition_retain.pdf

This is an edited excerpt from the 5G Americas white paper Wireless Technology Evolution: Transition from 4G to 5G. All sources are detailed in the white paper, which can be found at http://www.5gamericas.org/files/8015/4024/0611/3GPP_Rel_14-16_10.22-final_for_upload.pdf.