We’re at the Beginning of a Global Transition to Open Last Mile Digital Infrastructure —

A useful tool to understand major industry transitions and disruptive innovations is the Innovation S-Curve. (See Figure 1.) Historical examples of these transitions include the move from mainframe and minicomputers to the personal computer and more recently the jump from mobile phones to smart phones. These transitions, and many others, had major implications on the existing ecosystem and its participants. They spawned even bigger waves of innovation. As an example, not all ‘railroad companies’ successfully made the transition to become ‘transportation companies’.

Figure 1. Innovation S-Curve

In any industry, it’s a challenge for its current leaders to see the seeds of the next wave of innovation, since those seeds start out small and can be downplayed. Other challenges facing market leaders include big company inertia, installed bases, and previous investments. All of these things make the current market more attractive than an uncertain future market.

Innovation Is a Requirement

It’s no longer an overstatement to say broadband is critical civil infrastructure that’s necessary for community survival. Broadband, fixed, and wireless, are the roads to the Internet and to the Cloud. The time is coming when the lack of a modern broadband infrastructure will impact the local housing market and local business creation and retention. Without it, the young will move away, and new businesses will stay away. The type of roads a community has will determine its economic viability in the future.

Early on, these roads were built for analog voice or analog Cable TV. Then along came "The Internet" and "The Web". Incremental innovations such as DSL and DOCSIS gave new life to telephone and cable TV networks, and a created a new, highly profitable, revenue stream for network owners and operators. It also fueled an explosion in innovation in Web and now Cloud services. Next came streaming video (e.g., Netflix) and "everything over-the-top". This accelerated the nascent "cord cutting" trend past the pain threshold and made traditional TV/Video an albatross to incumbent triple play providers. All of these things make it a challenge for incumbents to invest in universal fiber to all reasonable premises and locations.

Cities and towns are not the only constituency at the mercy of local broadband infrastructure. Driving the demand for higher last mile bandwidth has been the rise of ‘The Cloud’ and of cloud companies (e.g., FAANGs — Facebook, Amazon, Apple, Netflix, and Google). Cloud companies, with few exceptions, are dependent on the incumbent broadband providers’ last 100’s of miles (middle mile and last mile) of ‘best effort’ networks to deliver their digital products to residential consumers.

As "The Edge" expands outwards, the distance will decrease, but with the current architectures and regulatory frameworks, it will remain ‘best effort’. Thus, the growth of these cloud companies, and the growth of the entire consumer cloud, is dependent on broadband providers willingness to upgrade to fiber. Cloud companies know this.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022The Future Is Open Fiber and The Time Is Now

Globally, we are at a critical inflection point. (See Figure 2.) We now have the perfect storm for quantum scale innovation:

1. Consumers demanding competitive choice.

2. Cloud companies demanding gigabit speeds for all users.

3. Communities demanding 21st Century infrastructure.

Figure 2. Last Mile Innovation S-Curve

What is the future of broadband? Is it a higher speed version of today’s Internet-centric monopolies and duopolies or an open innovation platform that will drive local and national economies for decades?

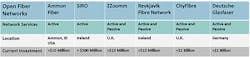

An emerging solution around the globe is the "Open Fiber Model". Figure 3 includes a representative group of open fiber networks that are either in operations or in the process of being built. Together they represent over $4 Billion in investments. There are many more in the US and around the globe including one aptly called Open Fiber in Italy.

Figure 3. Examples of Open Fiber Last Mile Digital Infrastructure.

These networks have a number of nuances based on factors such as localization and funding sources. There are also different terminologies, technical architectures, and business models. This is expected since we are at the beginning of this global transition. There are also fundamental commonalities which define the future of open fiber.

1. They all begin with the goal of universal Fiber-to-the-Premises (FTTP) with each household directly connected to fiber. Each homeowner then has a competitive choice for Internet service providers.

2. These networks are being built as long-term, 30-50 year, infrastructures. This can be seen in the construction methods and architectures selected. While they may start with a gigabit today, they are all being architected to support 10G and beyond. Many even insist on expensive trenching to ensure long-term survivability.

3. They are wholesale providers of last mile connectivity. All of them provide bit-stream or "lit"

services to service providers serving residential customers. Here, an Internet service provider would lease a lit circuit such as an Ethernet VLAN from their point of presence to the end consumer’s home. Many also offer a dark fiber option to service providers. Here, the retail service provider would need to install their own electronic equipment at both ends of the fiber. Dark fiber is also available to mobile network operators for small cell backhaul purposes.

4. Open fiber networks monetize their assets in multiple ways. The volume is in residental connections. However, the infrastucture is universal, and is available to mobile network operators for 4G and 5G backhaul and to other service providers, enterprises, and governments.

5. Other than Ammon Fiber, they are all privately funded. SIRO and Reykjavkik Fiber are funded by utility companies, and the rest are funded by Private Equity capital. The open fiber companies listed in the table represent over $4 Billion in investments. There are also global investment funds being created specially to target digital infrastructure.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

What Is the Future?

Will open fiber be the mainstream last mile digital infrastructure of the future or a niche market in a few select cities? Broadband has become too important to cities, and fiber is the preferred choice for last mile infrastructure including for mobile and 5G connectivity. The questions are: who is going to fund the construction, and how are they going to be compensated for their risk-taking and effort?

True innovations are the rising tide that lifts all boats. That’s why the Open Fiber Last Mile Digital Infrastructure will be the architecture of choice for communites around the globe. Open fiber benefits the entire broadband and cloud ecosystems, including the incumbent broadband providers. Properly structured open fiber networks are local economic development engines and together they are a global innovation platform. The results are $100’s of billions in digital infrastucture investments, waves of additional innovations, and vibrant communities of the future. Open fiber is the future of last mile digital infrastructure — and this future has already started.