When Generations Overlap

7 Emerging Network Architectural Themes for Network Evolution in 2020 —

Wireless and wireline networks are converging, using a common architecture for wireless and wired access, as well as fixed and mobile applications. Technology and deployment cycles are coming on increasingly fast, and starting with 5G and NGPON, are now overlapping the previous cycles of LTE deployment and copper-to-fiber conversion.

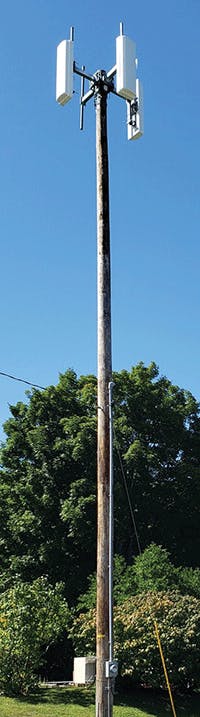

Figure 1. ILEC-owned and operated RADWIN wireless 2.4Ghz unlicensed fixed broadband site, fiber fed. ILEC-owned pole.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Carriers are now deploying 5G, even as they continue to densify 4G LTE. While copper has been slowly and inexorably replaced with fiber for both transport and local loops, carriers are deploying new kinds of PON networks, able to deliver 10 Gbps, in areas that still have copper. Even while Connect America Fund (CAF) projects provide federal support for upgrading DSL, incumbent local exchange carriers (ILEC) are deploying fixed wireless fed by fiber in areas traditionally served only by copper loops.

Figure 2. Cellular-carrier-owned and operated Ericsson 5G licensed mm band mobile (and fixed) broadband site, fiber fed. Municipal light pole.

The Breakdown of Order

Technology and finance people like to classify things. Network operators have been neatly categorized into cellular operators, telephone companies (ILECs), cable companies (multi-system operators or MSOs), wireless Internet service providers (WISPs), competitive local exchange companies (CLECs), and sometimes just Internet service providers (IPS) which includes fiber broadband providers that don’t switch voice traffic.

Each traditionally brings their own distinct network architecture and access technology to customers: the MSOs with hybrid fiber coax networks and DOCSIS, the cellular carriers with LTE, and the ILECs with TDM, Ethernet, and DSL.

Each carrier type has deployed successively faster and more capable networks in orderly tranches of network technology. For cellular carriers, this meant 2G, 3G, 4G, and now 5G. For ILECs, POTs voice service led to dial-up data at various speeds, followed by DSL in various flavors, and now FTTP.

This orderly categorization of network operator types, each using different access technologies targeting their own sub-set of the customer market, is breaking down while technology deployment cycles are speeding up and overlapping.

The current technology deployment cycles are generally standards-based, and agnostic to the type of company deploying the technologies. ILECs are deploying fixed wireless, cellular carriers are building the densest fiber networks, and MSOs are serving mobile users. If you like to neatly categorize network operator types and service just 1 customer type, this is a difficult world order!

The changes underway can be broadly categorized into 7 emerging network architectural trends:

Figure 3. ISP-owned and operated TV white space fixed broadband site, microwave fed. SQF-owned pole.

Trend 1. Wireless access for fixed and mobile loops

Network operators of all kinds now view wireless as a fast and affordable access technology for customers’ loops. Standards-based 5G and proprietary radios increasingly can deliver fiber-like loop speeds from hundreds of Mbps to several Gbps. For ILECs building in ultra-rural areas, fixed wireless is allowing them to stretch CAFII funding. Cellular operators are using their radio access networks (RAN) to serve fixed broadband customers with both LTE and 5G. MSOs have already deployed Wi-Fi hot spots across their networks and become virtual network operators (VNOs) for mobile customers. They are also exploring standards-based 5G access.

Trend 2. Increasing Network Density

Networks are getting denser to deliver both better coverage and capacity. Network operators of all kinds are deploying fiber closer to their customers to support both wired and wireless access. Even in places where carriers have had enough coverage, they are densifying their networks to provide better capacity to hungry data users. The most striking example of this trend is with cellular operators, who are deploying ~10 LTE small cell sites in the footprint of a tower, and will deploy dozens of 5G small cell sites in the same footprint. The relative scarcity of spectrum, and rapidly increasing customer demand for data, is driving the reuse of spectrum over tighter areas using small cells placed ever closer to each other.

Trend 3. Fronthaul Fiber

Wireless access for fixed and mobile loops is driving a new kind of fiber architecture, where there is very dense short haul fiber capacity to the wireless nodes, connecting it to more local hubs. This fiber is not backhaul — it’s part of the access technology being used at the network edge. What we have traditionally thought of as a wire center is now diffused into several localized nodes terminating many intermediate fiber runs to access radio technology located closer to customers.

To conserve fiber, carriers are reversing the 4G trend of remoting the baseband technology to the hubs as radio manufacturers deploy 5G radios with embedded baseband technology onboard at the edge. This plays against carriers’ desires to virtualize more of the radio access network, driving additional hardware revisions at the edge, and potentially reducing the importance (and space requirements) of hub locations.

Trend 4. Wireless and wireline networks are converging common architectures for both needs.

With all carrier types using wireless access for customer loops, supported by denser fiber networks, it’s more difficult to categorize network operators by type, because their network architectures are similar. Rural ILEC deployments of fiber-fed, pole-mounted Wi-Fi networks are starting to look like cellular small cell deployments. Fiber to the 5G small cell is quickly competing with hybrid fiber coax cable access and fiber-to-the-home for fixed broadband customers.

Many carriers view their network as being capable of serving all types of customers. Verizon, for example, deploys its NGPON2 fiber networks, paired with LTE and 5G access technologies to service enterprise, home, cellular, and wholesale customers. Similarly, Crown Castle, once focused on cellular carrier wholesale service, now deploys its fiber networks to service enterprise and wholesale customers over the same networks that support cellular fronthaul and backhaul.

Trend 5. Technology and deployment cycles are overlapping and harder to delineate.

Technology evolution is happening so fast now that carriers are fielding new technologies before they have completed deployment of the last technology. Data demand is escalating quickly enough to have carriers deploy 10 Gbps solutions and fixed 5G at >1 Gbps in territories where customers are converting from DSL to fiber-to-the-home at only hundreds of Mbps. NGPON2 networks will quickly raise expectations on data rates both to the home, enterprise, and to the wireless node at the edge to 10 Gbps.

Trend 6. It’s all about the poles.

Local utility poles are the new neighborhood nodes serving loops, replacing widely distributed cabinets in neighborhoods like DSLAMs. The need to have ultra-dense networks, very close to customers, relies on pole-mounted wireless access across nearly every network operator type. This is giving rise to national infrastructure providers specializing in pole nodal development, like Tilson/SQF, Crown Castle, and Extenet.

Trend 7. Software will define more, but not everything.

Carriers have long been chasing the promise of reducing CapEx intensity during the increasingly frequent technology upgrade cycle by using software defined devices, both for layer 2/3 equipment, and access technology at the edge. Large carriers have been successful at layer 2/3. Many continue to invest in software defined core and switching technology. However, carriers have been less successful with virtualizing radio access. Advances in beam forming technology, carrier aggregation, and changes to available spectrum, dictate different hardware. As previously mentioned, recent trends in integrating baseband functionality into 5G radios drives hardware revisions in the field, even as the embedded base of LTE radios enjoy some added functionality with software.

What Will Be in 2 Years?

The history of network evolution has been one of waves. The march of the Gs in cellular has paralleled the march of replacement transport and access technologies in wireline. One technology logically followed the next, lived its lifespan, and then the next wave started. What is happening today is a radical reorganization of the way we think about network evolution — wireline and wireless technologies are converging into common architectures meant to service all kinds of different customers.

Networks are getting denser and more CapEx-intensive, and technology refresh cycles are overlapping. What does this mean for carriers in the future?

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

More industry consolidation is on the way as network architectural trends require CapEx intensity that requires more market share of all kinds of customers to find a return. Carriers will need to defy narrow market segment focus, and leverage a dense, fiber-intensive network with radio access options to serve enterprise, residential, mobile, and wholesale customers, from a common infrastructure. That infrastructure is close to where customers are, including many pole sites in the public right-of-way. Access speeds are already at 10 Gbps for some FTTP networks. And as aging copper, and even first-generation fiber networks, are replaced with high-capacity NGPON2 fiber networks, carriers can rely on inexpensive radio access technology available at speeds over 1Gbps to reach customers competitively.

About the Author