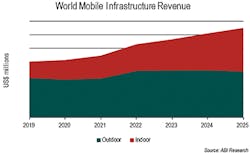

The global Radio Access Network (RAN) baseband and small cell equipment market will grow at a compound annual growth rate of over 8% to exceed US$32 billion in 2025. According to the new Mobile Infrastructure market data report published by ABI Research, a market-foresight advisory firm providing strategic guidance on the most compelling transformative technologies, these sales take into account both outdoor and indoor RAN equipment including macro basebands, outdoor small cells, indoor small cells, and Distributed Antenna Systems (DAS).

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Multiple technologies are converging in today’s RAN as network operators move to densify macro networks with small cells, tackle in-building wireless, and evolve to new technologies such as 5G, Licensed Assisted Access (LAA), unlicensed and shared spectrum technologies such as OnGo in the US, and MulteFire. These transitions are occurring against a backdrop of continuous technology evolution as networks upgrade to include Multiple Input Multiple Output (MIMO), Massive MIMO, 256 QAM, and carrier aggregation.

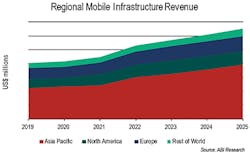

Spending on indoor equipment, which represents 30% of this market today, will grow at a compound annual growth rate of 17.7% to represent a value of 49% of the total by 2025. The Asia-Pacific region, which includes some of the largest and growing RAN markets in the world, will continue to dominate the market with a share of 60% of the market, with Europe and North America ranking a distant second and third respectively. Sales of infrastructure equipment will continue to be dominated by replacement and upgrades to 4G, but the ramp of 5G equipment gaining share starting in 2019 will reach parity with 4G around 2021 and will continue to grow to represent 90% of this equipment market worldwide in 2025.

Additional highlights include:

FACT #1: While the Asia Pacific region dominates in the share of this market, the North American and European regions each account for over 15% of the market in 2025.

FACT #2: While outdoor mobile infrastructure revenue dominates throughout the forecast period, the outdoor and indoor small cell licensed, unlicensed, and shared infrastructure, revenue will grow at a 20% CAGR.

FACT #3: New technologies in licensed, unlicensed, and shared, spectrum will continue to spur a healthy indoor wireless market.

In this convergence era, an unprecedented number of non-mutually exclusive technologies and architectures are uniting to provide wireless capacity and coverage, both indoors and outdoors. As the industry starts commercial 5G deployments outdoors in 2019, ABI Research anticipates that the requirements for good coverage and capacity indoors will drive signal sources indoors and will provide momentum to the in-building wireless market.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

These findings are from ABI Research’s Mobile Infrastructure market data report. For more information about the report, please visit https://www.abiresearch.com/market-research/product/1031929-mobile-infrastructure/. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and Executive Foresights. For more information about the research service, please visit https://www.abiresearch.com/market-research/service/5g-mobile-network-infrastructure/.

For more information, please email [email protected] or visit https://www.abiresearch.com/. Follow ABI on Twitter @ABIresearch.