Juniper Research defines AI as the simulation of human intelligence processes by machines, particularly computer systems that exhibit traits associated with a human mind such as learning and problem-solving. Among the specific applications of AI are:

• Machine Learning

• Deep Learning

• Computer Vision

• Neural Network

• Natural Language Processing (NLP)

In the context of our recent report, the term AI generally refers to products and services utilizing one of the above-listed applications to automate tasks, as well as augment human thought processes in accelerating tasks. For example, machine learning is an application of AI where machines can "learn" without needing to be programmed for that specific task.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022The network operator industry has always been directly affected by technological innovation and digital disruption. Notably, the past 10 years have been distinctive for several significant technological advances, including the mainstream penetration of AI and machine learning in communication services, the rise of highly customized Over-The-Top (OTT) applications, the rollout of superior connectivity modes such as 4G LTE and 5G, the rise of the IoT and connected devices, etc.

Digital transformation has significantly changed operators’ business models, which only a decade ago relied predominantly on SMS, MMS, and voice calls for revenues. In the face of the hyper-personalized, customer-centric and often free OTT alternatives, service providers have been placed under growing pressure to combat declining Average Revenues per User (ARPUs).

Indeed, for service providers to remain relevant, enabling a business-wide, AI-driven digital transformation has become inevitable in the face of severe OTT competition. Juniper Research estimates that total operator spend on AI will reach $4.3 billion in 2020. (See Figure 1.)

Figure 1. Total Network Operator Spend on AI per Annum in 2020: $4.3 Billion.

There has been growing rivalry between network operators and OTT service providers, fiercely competing for customers’ loyalty through ongoing innovations in user experience and service quality. In this respect, OTT providers have managed to move quicker and lead the way, benefitting from little interference from regulatory bodies, growing smartphone penetration, and increasing device capabilities.

Unlike network operators, OTT players are not required to purchase any form of licensing to offer their services. This lack of regulation has left the OTT market to be determined by competitive forces.

Why the Boost?

Juniper Research believes that the lack of regulation in this sector has enabled the staggering rise of OTT messaging and voice services, making it attainable for players such as WhatsApp, Line, WeChat, and others, to maintain low pricing business models and a fast-paced nature of offerings. (See Figure 2.)

Figure 2. Total Number of OTT Users vs Mobile Subscribers (m), 2016 & 2019.

Other factors such as prioritizing user-centricity and customization-enabled via AI capabilities have further lead to OTT players taking a significant share of the global messaging and voice market. Notably, AI adoption and machine learning play a crucial role in not only understanding user data, but also in deriving actionable conclusions on user emotions and preferences, while building accurate forecasts for anticipated behavior. These insights are at the heart of designing increasingly intuitive and user-friendly properties.

Juniper Research finds that Tier 1 network operators are beginning to catch up with this trend by increasingly prioritizing investment in Research & Development (R&D) and developing AI capabilities across the organization. Furthermore, we anticipate that Rich Communications Services (RCS) initiatives, combined with superior mobile voice services such as Voice Over Long-Term-Evolution (VoLTE) and HD Voice, have the potential to take back market share from OTT services over the next 5 years. This is due to the high quality and reliability of operator services, the simplicity of RCS, and the potential for integration with commercial websites and other services, which would translate into a smooth and frictionless user experience.

Juniper Research also anticipates that in the future, OTT players will face significantly sterner challenges than previously. As operators continue to further penetrate IP-based communications, OTT players must begin to guard against the increased innovation that this brings. Furthermore, we expect that with advancements in AI, there will be a growing volume of data-privacy and management policies introduced to the OTT space, with the potential to stifle expansion.

Investment Landscape

Juniper Research notes that since 2010, the general trajectory for AI investment has been upward, with more than 635 AI acquisitions to date. Indeed, the majority of these have been completed by large technology and service provider companies, which are increasingly concerned with leveraging machine learning to enable smooth customer interaction, more capable devices, and market dominance through innovation.

The acquisition of AI companies has been dominated by large technology companies, with the FAMGA group (Facebook, Apple, Microsoft, Google, and Amazon) investing heavily in recent times. This is based on their race not to be left behind in the search for effective AI solutions, many of which are being built into consumer smartphones. Among the FAMGA companies, Apple leads with 20 AI acquisitions since 2010, followed by Google with 14 acquisitions and Microsoft with 10.

In 2019, major AI acquisitions in the mobile operator space include:

• Huawei’s acquisition of Russian security systems provider Vocord for $50 million in June. Vocord offers technologies including facial recognition, video surveillance and analysis, video enhancement and authentication, license plate recognition, and audio recording. We note that this acquisition has been driven largely by Huawei’s goal to be a leader in handset innovation and capabilities. In the future, strong image and video authentication capabilities could indeed be used to feed into AI-driven customer support algorithms, as part of sentiment analysis, which could be deployed in a number of use cases. There are however major challenges to mainstream implementation, stemming from data protection concerns and customers’ aversion to interact with video.

• Reliance Jio purchased an 87% stake in Mumbai-based chatbot company Haptik Infotech for $101.2 million in April. This will allow the company to compete directly with Amazon Alexa and Google Assistant in the Indian market.

Moreover, according to EY’s 2019 Global Capital Confidence Barometer surveying Mergers & Acquisitions (M&A) sentiment across industries, more than 55% of participating operators expect to complete acquisitions over the next 12 months, growing from 45% the year before. The survey also notes that MNOs increasingly demonstrate appetite for acquiring AI and tech-driven start-ups, making up for the bulk of M&As, as opposed to the traditionally popular consolidation of operators.

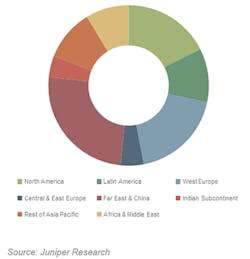

Total operator spend on AI solutions will exceed $15 billion by 2024; rising from $3 billion in 2020. (See Figure 3.) We have identified that network optimization and fraud mitigation solutions as the most highly sought-after AI-based services over the next 4 years. AI-based solutions automate network functionalities including routing, traffic management, and predictive maintenance solutions.

Figure 3. Total Network Operator Spend on AI per Annum ($m) Split by 8 Key Regions in 2024: $15 Billion.

HIGHLIGHTS

Additional highlights of our research include:

• Operators in developed regions, such as North America and Europe, will account for over 40% of AI spend by 2024, despite only accounting for less than 20% of global subscribers. A growing demand for operational efficiencies will drive operators in these regions to increase investment in AI over the next 4 years.

• Operators must embrace a holistic approach to AI implementation for service operations, rather than applying separate AI strategies to individual use cases. They must leverage AI to unify internal data resources and encourage cross-functional insight sharing on network efficiencies to maximize the benefits of collaboration across internal teams.

• AI spend by emerging markets operators will exceed $5 billion by 2024, rising from only $900 million in 2020. This growth will be driven largely by operators exploring early use cases of AI, before expanding the presence of AI in their networks to include more comprehensive services.

• Indian Subcontinent and Africa & Middle East will experience the highest growth in spend on AI services, with operator spend in both regions forecast to grow over 550% over the next 4 years. Operators in these regions will initially invest in AI-based CRM solutions that yield immediate benefits.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

For more information, please contact [email protected] or download the white paper at https://www.juniperresearch.com/document-library/white-papers/how-ai-analytics-will-boost-operators-revenue.