Big 5G Things Come in Small Packages

Worldwide Small Cell Forecasts 2019-2027 —

The ever-rising demand for fast mobile data connectivity among consumers has surged the deployment of the next-generation Radio Access Network (RAN). The installation of small cell 5G networks is rapidly increasing in enterprises, industrial, and residential applications, to provide enhanced coverage capacity at an affordable cost.

The global small cell 5G network market size was valued at USD 310.8 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 77.6% from 2020 to 2027. In terms of volume, the market was worth 215 thousand units in 2019, according to a recent report by Grand View Research.

Rapidly rising mobile data traffic across the globe enables telecom operators to migrate towards network densification to provide the high-speed capacity to mass consumers. The global mobile traffic is anticipated to rise more than 175 exabytes/month by 2027, which will be more than 50% carried by the 5G network. (See Figure 1.)

Figure 1.

The deployment for next-generation small cell networks is estimated to witness significant growth over the forecast period. This is attributable to the increasing demand for a 5G network from a massive chunk of customers at public locations such as malls, offices, and stadiums. Also, the demand for 5G data services for several use cases, including Ultra-high Definition (UHD)/4K video, seamless video calling, and cloud-based VR/AR gaming is rapidly mounting. As a result, it is further anticipated to boost the market growth over the forecast period.

Some of the largest economies, such as the US and China, are expected to continue spending aggressively on provisioning healthcare facilities. For instance, the National Health Expenditure Accounts (NHEA) of the US expects the overall healthcare spending in the US to reach around USD 6.0 trillion by 2027, exhibiting a CAGR of nearly 5.5% from 2018 to 2027. The healthcare industry, especially in developed economies, has begun emphasizing concepts like remote diagnosis and surgeries to the patients. Additionally, the COVID-19 pandemic has enabled several key countries to build more robust healthcare capabilities through investing in advanced technologies such as 5G infrastructure. Thus, to deliver constant data connectivity during remote patient surgeries and telemedicine, the demand for small cell 5G network is expected to drive the market growth from 2020 to 2027.

The outbreak of COVID-19 is certainly expected to slow down the implementation of 5G infrastructure owing to the interruptions in further trials and testing needed for validating the stability and processing performance of 5G networks. Additionally, due to the COVID-19 pandemic, key countries such as China and the US have seen a robust decline in the trades of small cell telecom equipment for 5G New Radios (NR).

Besides, the ongoing pandemic has had an additional impact with telecom regulatory authorities postponing their plans of 5G spectrum auctions, thereby adversely impacting the market growth. For instance, governments in a few key countries, including the US, France, Spain, and Australia, have temporarily postponed the spectrum auctions on several frequencies, such as Sub-6 GHz and mmWave.

The aforementioned factors are collectively expected to pose a challenge to market growth, especially over the next couple of years. Moreover, the escalating trade war between the 2 largest economies like China and the US is further anticipated to hinder the market growth.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Component Infrastructure Insights

In terms of volume, the femtocell segment dominated the market with a share exceeding 60% in 2019. This is attributed to its increasing demand to attain unified bandwidth coverage for several enclosed applications such as malls, homes, offices, and hospitals. Small cells are mainly available into 3 categories, including femtocells, picocells, and microcells, based on their different ranges. The covering bandwidth ranges of femtocells, picocells, and microcells, encompass up to 50 meters, up to 250 meters, and up to 3 Kilometers, respectively.

Picocells play a vital role in covering a large portion of the population, delivering high-speed Internet capacity in places like stadiums, concerts, festivals, and others. Moreover, telecom service providers are still facing uninterrupted data services across rural areas due to line-of-sight problems. Microcells provide seamless connectivity to consumers, especially in remote or rural areas, up to 3 KMs of distance. Due to the aforementioned factors, it is expected to stimulate the implementation of picocells and microcells over the next 7 years.

In terms of value, the non-standalone (NSA) network model dominated the market with a share exceeding 85% in 2019. This is attributed to the early rollouts of the non-standalone network across the globe. The non-standalone network is generally deployed in integration with the existing legacy network infrastructure. Besides, several key service providers such as AT&T, Inc, Verizon Communications, and China Mobile Limited, have firstly deployed a 5G NSA network model catering to primary uses cases such as cloud-based AR/VR gaming and UHD videos.

The swiftly rising industrial digitalization has paved a new revenue stream for service providers across the globe. To provide endless connectivity between machines to machines, the need for the ultra-reliable high frequency with low latency communication is a prerequisite. Besides, the need for unified bandwidth capacity with minimum latency to establish seamless communication between autonomous vehicles is expected to drive market demand in the transportation & logistics segment. Therefore, the growing need for faster data speed across the verticals, as mentioned above, is anticipated to boost the deployment of the standalone network model during the forecast period.

Network Architecture Insights

In terms of value, virtualized network architecture dominated the market with a share of more than 55% in 2019. This is attributed to a robust deployment of small cell 5G network with a centralized baseband unit controllable architecture. This helps service providers to reduce the Total Cost of Ownership (TCO) and increase the overall flexibility of the network by managing virtually all the small cell base stations.

The introduction of Software-defined Networking (SDN) technology and Network Function Virtualization (NFV) to improve the operational efficiency of the RAN network is further expected to augment the segment growth from 2020 to 2027.

Key telecom operators are massively investing in deploying virtualized small cell 5G network infrastructure across several major countries. For instance, in May 2020, China Telecom and China agreed with Ericsson to deploy cloud-based 5G radio access and core network on various frequency spectrums, including low band mid-band. This project will help these communication providers (CSP) to cut the overall infrastructure costs and network complexities. As a result, it is further expected to assist the virtualized segment in reaching market revenue of USD 19.89 billion by 2027.

In terms of value, the indoor segment dominated the market with a share of exceeding 80% in 2019. This is attributed to the reliable deployment of next-generation small cells across several residential and non-residential applications. The non-residential uses mainly involve enterprises, retail malls, airports, and hospitals, among others. Moreover, according to the data published by China’s Ministry of Industry and Information Technology (MIIT) states that the high-value customers are devoting over 80% of their working hours in the indoor premises. As a result, it is estimated to elevate the adoption of small cells for indoor applications in the next 7 years.

Outdoor small cells are primarily installed for public networks in suburban, urban, or rural areas. The swiftly growing number of Internet of Things (IoT) devices across many applications such as autonomous vehicles and vehicles to infrastructure (V2I) connectivity have generated the need for high-speed data capacity. Additionally, the deployment of lamp post small cells is gaining popularity in rapidly building smart cities across the globe. This, in turn, is estimated to fuel the growth of the outdoor segment at a CAGR of 87.6% from 2020 to 2027.

Frequency Type Insights

Sub-6 GHz dominated the market with a share of more than 90% in 2019. This is attributed to the enormous investments by key communication service providers in acquiring low- and mid-band frequencies to deliver high bandwidth services to consumers, businesses, and industries.

Recently, the governments across key countries such as China, the US, Japan, South Korea, and others, released sub-6 GHz frequencies to provide high-speed Internet services in their countries. Furthermore, few key small cell component providers such as Qualcomm Technologies, Inc., unveiled new chipset for 5G small cells, which supports both sub-6GHz and mmWave frequency bands. To support these multi-band frequencies, the sub-6GHz and mmWave segment are expected to gain considerable market growth in the forecast period.

In applications where ultra-reliable connectivity is a prerequisite, mmWave frequencies provide enhanced bandwidth capacity with very low latency — especially in remote patient surgeries and vehicle to vehicle (V2V) connectivity.

Additionally, few federal governments across developed economies have released mmWave spectrum bands to provide enhanced data services. For instance, the Federal Communication Commission (FCC) released several mmWave frequencies, including 24.25-24.45 GHz, 47.2-48.2 GHz, 24.75-25.25 GHz, and 38.6-40 GHz, among others with an objective to deliver ultra-reliable connectivity for applications such as autonomous vehicles. Countries like Russia, Japan, South Korea, and Italy, have released mmWave frequencies for improved data capacity. Thus, increased focus to release mmWave frequencies by key federal governments across many countries is expected to augment the mmWave segment growth from 2020 to 2027.

End-User Insights

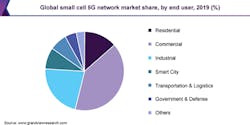

In terms of value, corporate/enterprises dominated the market with a share of nearly 60% in 2019. This is attributed to the growing deployment of small cell 5G networks across large as well as Small and Medium Enterprises (SMEs) across the globe. This 5G RAN network helps enterprises cater to the demand for massive data capacity and coverage needs at a very affordable cost. Moreover, small cell 5G networks also help organizations to utilize the existing broadband infrastructure to deploy these next-generation networks. (See Figure 2.)

Figure 2.

The robust increase in Industrial IoT devices (IIoT) has created the demand for unified data connectivity to establish constant communication among these devices. These IIoT devices mainly include Ultra-HD wireless cameras, extended reality headsets, Automated Guided Vehicles (AGVs), and collaborative robots.

To provide seamless connectivity with low latency, the installation of small cell 5G network for industrial applications is expected to showcase a massive growth over the forecast period. Moreover, another critical use case, such as asset monitoring in the energy & utility sector, is anticipated to experience strong growth in the coming years.

Geographical Differences

In terms of value, Asia Pacific dominated the market for small cell 5G network with a share of more than 30% in 2019. This is due to the aggressive deployment of 5G new radio infrastructure by major communication service providers such as China Mobile Limited; KT Corporation; Rakuten Mobile, Inc.; and NTT Docomo Inc. In addition, governments across key countries such as Japan, China, and South Korea ,are highly focused on releasing multiple sub-6GHz and mmWave frequencies to cater to the growing need for high-speed data connectivity among large subscriber base. Consequently, the market in the region is anticipated to experience robust growth over the forecast period.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

With the presence of large service providers such as AT&T Inc., Sprint Corporation, T-Mobile, and Verizon Communications, the US market is also expected to grow at a significant rate over the forecast period. A multitude of investments made in deploying small cell network by the afore-mentioned companies is anticipated to help the market reach USD 7.05 billion by 2027. For instance, in September 2018, T-Mobile signed an agreement with Ericsson a worth of USD 3.5 million to support T-Mobile’s 5G network infrastructure. Also, in this deal, Ericsson will provide 5G New Radio (NR) hardware and software to T-Mobile for offering high-speed internet.

Resources and Notes

"Small Cell 5G Network Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By Network Model, By Network Architecture, By Deployment Mode, By Frequency Type, By End-user, And Segment Forecasts, 2020 – 2027", published by Grand View Research, July 2020.

For more information, and to download the report, please visit https://www.grandviewresearch.com/industry-analysis/small-cell-5g-network-market?utm_source=prnewswire&utm_medium=referral&utm_campaign=ict_28-jul-20&utm_term=small-cell-5G-network-market&utm_content=rd