Latest from Network Transformation/Edge Compute/IoT/URLLC/Automation/M2M

COVID-19 Cuts Into Smart Home Growth

Spending Decreases Now, But Drives Future Change —

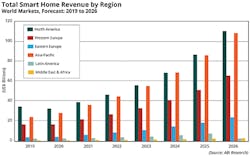

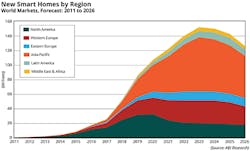

Despite the pandemic’s impact around the world, consumer smart home spending will still grow in 2020. However, spending will be well below of pre-COVID-19 expectations. A new study from global tech market advisory firm, ABI Research, finds that smart home revenues will reach US$85 billion in 2020, just a 4% increase over 2019. Pre-pandemic 2020 smart home revenue growth was forecasted to hit 21% over 2019 — a US$14.1 billion loss.

Economic uncertainty, consumer spend constraint, restricted physical retail opportunities, installation restrictions, disrupted manufacturing, and distribution, all have curbed smart home spending, but the study finds that the spending shortfall is temporary.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022The pandemic is a double-edged sword for the smart home industry. While the immediate impact may be negative, many of the long-term and structural changes to consumer lives initiated in 2020 will have a lasting positive impact that will help to drive adoption in many areas of the smart home space.

As restrictions and drags on smart home shipments recede, a greater momentum behind smart home support across a range of devices and systems will push annual smart home revenue higher. By 2026, the smart home market will reach US$317 billion, up 5% over pre-COVID-19 forecasts.

Much of the revenue lost in 2020 will be deferred to the next and following years, especially as smart home has cemented its value to vendors and consumers alike. Smart home has an increasingly valuable role to play in consumers’ lives and spending habits. Amazon’s Alexa platform, for example, eases consumer spending through Amazon’s own stores by supporting the entire process from shopping list creation to delivery management. This highlights the trajectory for smart home to increasingly shape and drive consumer spending.

However, as new players come into the smart home space, spending will differ from pre-COVID-19 investments in terms of the technologies supported. Lost 2020 shipments will impact the longevity and appeal of some approaches, such as traditional motion and contact sensors. Instead, these capabilities will be adopted as features within video camera monitoring, or technologies such as Wi-Fi Motion sensing from companies like Cognitive Systems and made available through support in broadband routers. New and existing smart home vendors are set to use new ways to bring smart home functionality at lower price points or with less hardware.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

Additional report highlights include:

• The impact of COVID-19 will be uneven across smart home device types.

• Similarly, consumer smart home engagement varies regionally and nationally.

• COVID-19’s impact has particularly impacted smart appliances over most smart home devices.

COVID-19 may have impacted smart home revenues this year, but in the long term, it will also help draw investment, drive greater adoption, and disrupt smart home technology integration.