Work-and-Learn-From-Anywhere Requirements Force Fiber Upgrades —

In 2020’s rapidly changed network-centric world of increased broadband performance and demographic shifts from dense urban cities to less-crowded areas, 10G-GPON is the way to meet current and future broadband needs for existing customers and newcomers alike.

Service providers deploying and extending fiber services may be comfortable with GPON for current networks and considering it for upgrading existing infrastructure, but there are limits. Deploying GPON has lower cost CPE, but also lacks the capacity to support higher service speeds and additional demanding users, especially critical for business customers and multi-tenant dwellings (MDUs).

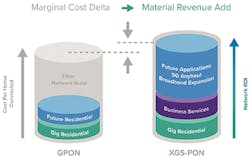

Figure 1. GPON – XGS-PON Comparison: Cost per home connected, Capacity and ROI.

Planning and implementing 10G-PON technology today provides flexibility to scale services and service areas, addressing a variety of situations in the future thus affording future cost savings by avoiding truck rolls related to technology upgrades. (See Figure 1.)

And the future always holds surprises. The broadband’s industry’s pre-2020 understanding of capacity needs was thrown out the window by COVID-19 in the spring of 2020 with businesses implementing Work-From-Home/Work-From-Anywhere (WFH/WFA) policies. Educators across the K-University spectrum grappled with newly implemented Learn-From-Home (LFH) practices. Doctors and therapists implemented virtual office visits, and online ordering took center stage for everything from toilet paper to cocktails from the local bar.

Bandwidth traffic grew by as much as 40% within a few weeks of COVID-19’s WFH/LFH policies being implemented, according to the Internet Society, growth more typically seen by service providers taking place over the course of an entire calendar year. Larger upstream and symmetrical bandwidth requirements once considered as an afterthought for households became necessary with the overnight embrace of Microsoft Teams and Zoom for businesses and education.

Overall network usage patterns for households shifted from 4:00 PM and later weighted towards downstream media such as Netflix and other streaming services in the evenings to workday hour usage. Compounding matters was the need for the whole family to be able to conduct real-time communications at the same time, with a 2-income family plus 2 middle-school children household needing a broadband connection capable of reliably supporting 4 upstream video sessions Monday-Friday starting at 8:00 AM through the length of the school day.

Spring 2020’s monumental broadband network usage shift was 1 of 2 significant waves that ripped through society. Data published by LinkedIn in September 2020 showed smaller metro areas gaining in population, big cities losing population, and suggestions of de-urbanization found across the country. Jacksonville; Salt Lake City; Sacramento; Milwaukee; and Kansas City, Missouri, were the biggest gainers in net arrivals from April to August 2020, while New York City and the San Francisco Bay Area both had over 20% declines in new people coming in.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Work-from-home was fine for those already accustomed to working from home 5 days a week, but individuals and families new to the practice found themselves longing for more physical space for work and leisure.

• Without the need for the daily office commute, favorite vacation areas became practical living spots — if there was sufficient broadband available.

• Urbanites and suburban households realized they could pick up and move to save money and get a bigger home with WFH/WFA policies, becoming a wave of office cord cutters no longer needing to be tied to a specific location in order to make a living.

• Lost commuting time converted into extra hours for biking, the kids, a new dog, or a larger garden.

• Many people from small towns around the country dream of returning home after college. Until now, such opportunities were fleeting, requiring a local employer. Gigabit-class broadband creates a new portfolio of options for homecoming, working for firms that have embraced telework or starting fresh businesses.

• Companies still embracing physical locations are also examining moving options, seeking better quality of life and lower cost of living for themselves and their employees.

• Gigabit Cities like Chattanooga can vouch for the power of high-speed broadband bringing firms into town and increasing the local tax base.

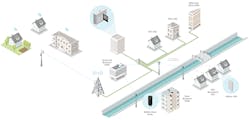

Overbuilding in anticipation of future growth is nothing new. Nearly all service providers deploying fiber, regardless of type — urban or rural, CLEC or co-op — deploy the maximum number of physical strands that they can afford, typically going with 288 strands as much as possible when current plans only anticipate usage of a fraction of the capacity. Around 80% of the cost in physical fiber deployment is in labor while only 20% is in the materials.

GPON = Open Highway

GPON is a mature technology, standardized in 2003 and progressively updated over the past 17 years, while 10G-PON has been around for around a decade (XGPON1), and more capable symmetric variants (XGS-PON) have been deployed since 2017. While 10G-PON gear is slightly more expensive today, the price differential has been rapidly dropping and is expected to match G-PON pricing within the next 24 months,

according to analyst forecasts. Omdia Principal Analyst Julie Kunstler says 10G-PON shipments are

expected to dominate the industry by the second half of 2023.

For a greenfield installation, installing 10G-PON upfront makes fiscal sense because it avoids future truck rolls down the road when there is a need to increase overall network capacity due to expanded customer usage, adding new customers and service areas, and changes in the competitive landscape.

• Rolling trucks and on-site technicians to retrofit customer CPE become preventable.

• Construction of a 10G-PON network becomes a one-time set-it-and-forget-it proposition, with services turned up and new ones added via software with minimal on-site technician hours.

• Operators gain from long-life components and network technology able to expand with future customer needs with minimal to no technician fieldwork, while offering numerous speed options from typical 100Mbps or Gigabit consumer through differentiated multi-gig symmetrical business speeds with exacting SLAs, which in turn support higher tariffs.

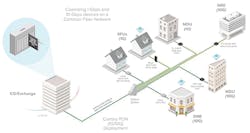

Figure 2. Combo PON: Combined XGS-PON and GPON technologies across a common ODN from a single OLT port.

However, 10G-PON isn’t just for greenfield builds. Existing fiber networks gain considerable benefit from incorporating 10G to support future service area and service expansions. Selectively deploying 10G-PON into an existing fiber network, either as an overlay to GPON or the more simplified Combo PON strategy, can provide more broadband for existing business users and in multi-tenant buildings, such as apartments and Main Street business areas now more reliant on e-commerce than ever before. (See Figure 2.)

Some carriers will be deploying 10G-PON instead of G-PON due to competitive necessity.

• Incumbent fiber operators may already offer symmetrical gigabit speeds while cable providers are leveraging DOCSIS 3.1 to offer multi-gigabit packages, and planning the next speed upgrade with DOCSIS 4.0 capable of delivering 10 Gbps downstream and up to 6 Gbps upstream.

• Mediacom Communications recently demonstrated a 10G Smart Home in Ames, Iowa on an existing DOCSIS 3.1 hybrid fiber/coax (HFC) infrastructure, and delivered 5 Gbps upstream with 1.2 Gbps

upstream, speeds sufficient to support holographic 3D light field displays and 8K video streams.

• In such markets, stock gigabit broadband services are a non-starter and service providers need 10G speeds to be viable in current and future business and residential offerings.

Figure 3. Fixed Wireless Access: Extending fiber reach with mesh mmWave and CBRS.

Beefing up network capacity is also necessary to support the rollout of new wireless capabilities hitting the market now. Cellular companies always want more capacity, with 5G being the latest technology iteration being deployed across the country. While "real" 5G coverage in your town may not be available today, it is a technology wireless carriers are working to deploy in the future as a way to meet their CAF obligations. (See Figure 3.)

Next-generation wireless technology building on millimeter wave frequencies and mesh networking can deliver multi-gigabit-class services but need multi-gigabit network fiber links to truly be effective and meet the expectations of customers. Most carriers deploying fiber view wireless mesh network as an essential complement to successfully extending gigabit coverage beyond the existing fiber footprint.

Deploying and upgrading fiber networks is never done lightly. With G-PON’s maturity and increasing demands for symmetrical 10G services to support evolving home, business, and community, broadband needs, 10G-PON should be considered as the best logical choice today for delivering broadband services, and providing a future-proof path for delivering new services and expanding service into new geographies.

For more information, please visit https://www.adtran.com/ or contact us at https://portal.adtran.com/web/page/portal/Adtran/waverunner_page_globalsalescontacts

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

References and Notes

https://www.internetsociety.org/blog/2020/05/how-has-covid-19-impacted-last-mile-networks/