Managing the Looming 5G Energy Surge —

There is a natural tendency to treat the move from 4G to 5G networks much like the move from 2G to 3G or 3G to 4G. This is a mistake. 5G is another animal altogether, a step change that 451 Research called "the most impactful and difficult network upgrade ever faced by the telecom industry." This is not hyperbole.

The only way to fulfill the promise of 5G is to fundamentally change and expand existing networks. A fully realized 5G network requires more sites at the edge (another step change we will discuss later) to deliver what ultimately will include, among other use cases, life-critical applications such as advanced telemedicine and, eventually, autonomous vehicles.

But 5G networks also will be far denser than existing 3G and 4G networks in order to meet bandwidth and latency demands of these applications and their users. And these will not replicate traditional sites, but rather will be new models featuring far more IT equipment that consumes much more energy.

That last point is important. Yes, 5G networks will be more efficient on a per-gigabyte basis, but the massive increase in the number of sites and the energy demands of those sites will result in a corresponding spike in energy consumption.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022How significant a spike? Global mobile data traffic will grow almost fourfold by 2025, leading to an overall increase in network energy consumption of 150-170% by 2026 according to Vertiv’s own estimates.

This isn’t a surprise to most telecom operators. According to that same study from 451 Research, developed with Vertiv, 94% of operators anticipate an increase in energy consumption with the rollout of 5G networks.

Of course, understanding the problem and solving it are 2 different things. The best opportunity to do the latter will pass quickly as operators race to deploy their 5G networks, with some potentially prioritizing speed over prudent energy strategies in the rush to reach users first. That urgency is understandable; according to IHS Markit, 5G is expected to generate $13.2 trillion in sales enablement by 2035. The race to 5G is nothing short of a gold rush.

Those same financial drivers eventually will force a hard look at energy consumption across these networks. According to the GSMA Intelligence and ZTE "5G Energy Efficiencies: Green is the New Black", more than 90% of network operating costs are spent on energy consumption. If deploying quickly is Priority 1, managing energy consumption and reducing those costs is going to be 1A. There are a variety of strategies and tactics to consider, ranging from modest steps that all operators should be implementing, to more ambitious approaches requiring a visionary rethinking of site architectures.

Lithium-ion batteries weigh 70% less, charge 33% faster, and last six times longer, than VRLA batteries in telecom applications. (All images provided by, and are property of, Vertiv.)

The Low-Hanging Fruit

5G networks require a lot of new cell sites, but they also will rely on many thousands of existing locations, many of which are equipped with older, inefficient equipment. Replacing legacy DC power systems with newer systems with high-efficiency rectifiers can improve efficiency of the power system by 5%-6%. And, it should go without saying that any new sites should be configured with efficiency front of mind.

Traditional cell sites offer relatively static operating modes, but today’s equipment is more intelligent and capable of reducing costs through smarter operation — activating sleep modes to avoid operation during peak hours, and storing cheaper, off-peak energy for use later, for example.

Even batteries present opportunities for efficiency improvements.

• Lithium-ion (Li-Ion) batteries are smaller, lighter, and longer-lasting, than traditional valve-regulated lead acid (VRLA) batteries, with a falling price point that makes the ROI more than acceptable.

• The smaller footprint and better thermal performance of Li-Ion reduces the energy required for cooling (and cooling costs).

• Li-Ion further reduces energy-related costs and overall organizational CO2 emissions by extending the life of the batteries, and thus reducing monitoring and replacement needs, truck rolls, and costs.

• Additionally, Li-Ion batteries with intelligent battery management systems enable peak shaving, boost conversion, and allow above-capacity power system operation, which can be valuable pieces of a comprehensive energy strategy.

This is another approach with significant upside; according to the 451 Research study, 66% of telcos were in the process of upgrading their batteries and 81% said they would do so within 5 years.

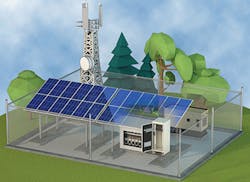

Leveraging solar as a primary or supporting source of energy in telecom applications enables operators to minimize their dependency on the grid while reducing their carbon footprint. (All images provided by, and are property of, Vertiv.)

Bigger Commitment, Bigger Benefits

Perhaps the most significant difference between 4G and 5G is the introduction of IT equipment at each cell site. This is the promise of 5G — the ability to process data and perform computing at each site and microsite to enable ultra-low-latencynapplications for the end user.

That IT equipment doesn’t fit seamlessly into traditional telco sites, however. Anyone who has been involved in the transition of legacy central offices into modern core facilities, that look for all the world like data centers, knows this all too well.

The differences have a real impact on energy consumption and costs. Let’s start with the obvious: IT equipment runs on AC power, while telco networks have relied on DC power for about a century. Introducing AC-powered equipment into these environments adds a power conversion step, and those extra conversions result in energy drops and generate heat. So, you have to start with more power to effectively accomplish the same result, adding heat that also needs to be removed in the process.

These may seem like small issues, and for a single site, that’s true. But remember this and apply it to every small issue we discuss here: these network sites number in the tens of thousands — in some cases hundreds of thousands. Any modest site-level improvements add up quickly.

So, about that heat. On top of adding heat, IT equipment is more sensitive to heat and humidity than traditional telecom equipment, meaning environmental control is more critical than it has been in the past. You can place this equipment in those 40-foot concrete shelters common to many cell sites, but then you have to cool those enclosures. Even if you recognize the wider operating range of modern servers and IT equipment — and if you don’t, that’s another easy energy-saving change you should adopt — cooling those big, concrete structures requires a lot of cold air and a lot of energy.

The alternative is a smaller, modern enclosure designed to better protect sensitive equipment from the elements and to better manage the heat inside. These enclosures can leverage different types of cooling — from free outside air to liquid cooling technologies, and everything in between — to provide the necessary thermal management for a given site in any given location.

Intelligent management systems add another layer of efficiency by using artificial intelligence and data analytics to continuously calibrate optimal thermal settings and tailoring the operation of pumps and fans to achieve the best possible outcome.

These conversations aren’t happening nearly as often as they should. Understanding the scale of the challenge as we consider the increasing number of sites, and the changing nature and thermal profile of those sites, should act as a motivator for further discussion.

Central Office Re-Architected as a Datacenter (CORD) brings data center economies and cloud agility to service providers. (All images provided by, and are property of, Vertiv.)

Embracing the Inevitable

There are other drivers for reducing energy consumption across these networks. Most significantly, the global focus on climate change and reducing emissions will inevitably lead to widespread efforts to reduce the amount of energy telcos are using.

Verizon and Vodafone are aiming for net-zero emissions by 2040, and Telefónica has committed to net-zero in its top 4 operating markets by 2030. To get there, Verizon and Vodafone are targeting 50% reductions in electricity usage by 2025, and Telefónica a 70% reduction by 2030.

These are big, bold goals requiring big, bold strategies. Everything we’ve discussed to this point almost certainly will be part of these plans, but no one is reducing energy use by 50% or getting to net-zero emissions strictly through high-efficiency components and smarter approaches to cooling.

This is where renewable energy sources and hybrid power systems come into play. These are not foreign concepts for most of the world; Africa and Europe have been at the forefront of hybrid deployment for 2 decades. The United States, however, has been slower to adopt hybrid systems as anything other than a niche solution. The reasons are well known: the cost and availability of energy in the US is low, while the cost for solar panels and power — the primary renewable source for hybrid systems — has been high. The economics have never supported widespread adoption of solar power and hybrid systems.

That is changing, at least in parts of the country. The 40 million residents of California can attest to the rising costs of power in that state, as well as the relative instability of the grid compared to most of the country. At the same time, advances in solar technologies have reduced costs on that front, bringing the cost-per-kilowatt-hour closer to grid parity and well into the range of viable alternatives. For on-grid deployments, a solar add-on is a way of reducing reliance on the grid without having to increase infrastructure costs for better batteries and the like. When available incentives are factored into the mix, solar-based hybrid power systems are a solid recommendation. We can safely say the same in similar states with abundant sunlight and high energy prices — a list likely to include much of The Sun Belt by the end of the decade.

We can’t ignore the changing political climate in the US. The incoming administration has pledged to re-enter the Paris Climate Accord, and the commitments related to that are likely to trigger widespread actions not just among telecom operators, but across industries. Simply put, the incentives to reduce energy consumption and emissions have never been higher.

Bottom Line

We have just scratched the surface of what is needed to manage the increased energy needs of 5G networks, and the truth is that all of these approaches, and countless others, will be parts of the solution. In fact, they will work best when incorporated together, with even small gains making a major difference when multiplied by scale and compounded by creating a cascade effect, with each step magnifying the impact of the one before.

References and Notes

IHS Markit, https://ihsmarkit.com/

See the whitepaper Telco Industry Hopes and Fears: From Energy Costs to Edge Computing Transformation, commissioned by Vertiv. https://www.vertiv.com/497746/globalassets/documents/white-papers/451-research-paper/10648_advisory_bw_vertiv_266274_0.pdf

See the report Global 5G Landscape Q2 2020, GSMA Intelligence, July 2020. https://s3.eu-west-2.amazonaws.com/uploads-7e3kk3/4816/global-5g-landscape-q2-2020.adc4f677966b.pdf?ID=a6g1r000000yW5AAAU&JobID=587882&utm_source=sfmc&utm_medium=email&utm_campaign=MWL_20201120&utm_content=https%3a%2f%2fs3.eu-west-2.amazonaws.com%2fuploads-7e3kk3%2f4816%2fglobal-5g-landscape-q2-2020.adc4f677966b.pdf

See the report press release at https://www.vertiv.com/en-emea/about/news-and-insights/news-releases/mwc19-vertiv-and-451-research-survey-reveals-more-than-90-percent-of-operators-fear-increasing-energy-costs-for-5g-and-edge/.

See the report at https://res-www.zte.com.cn/mediares/zte/Files/PDF/white_book/202011241046.pdf.