Government Funding, Private Networks, and Managed Services —

The Biden administration is working with Republican lawmakers to provide an unprecedented amount of federal support for broadband builds in unserved and underserved areas. Coupled with existing federal broadband programs, funding could provide up to $100 billion to build new networks — which would go a long way to bridging The Digital Divide.

The proposal prioritizes spending for government-run or nonprofit networks. As the White House explains, those providers have "less pressure to turn profits" and "a commitment to serving entire communities." Not surprisingly, trade groups representing broadband providers are pushing back on such conditions and would like to see a more balanced approach to public and private partnerships.

We expect fixed-line broadband networks to garner the largest share of financial support, however, 5G networks play a role, especially in high-cost, low-population density areas.

For rural America to reap the benefits of high-speed 5G, the networks must operate on mid-band spectrum. The FCC recently made a large swath of mid-band spectrum in the Citizens Broadband Radio Service (CBRS) band available for unlicensed use, and offered small chunks of licenses that rural operators could afford. The CBRS band and the rural expansion from national operators (T-Mobile being the most active) offer interesting opportunities.

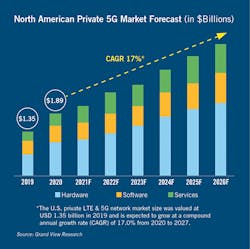

As the technical and cost barriers fall, a growing number of large enterprises are implementing private wireless networks. (See Figure 1.) These custom-built wireless networks can deliver many of the benefits

of automation, efficiency, and security, that 5G promises. For rural operators, designing, building, and running, private 5G networks could be a new business opportunity.

Figure 1.

For example, 5G private networks could help a rancher monitor herd health in real time, enabling them to proactively administer medical care. Or a manufacturing plant could increase its level of automation with 5G sensors communicating with each other and over a server in real time. We note that John Deere is already moving in this direction with plans to improve operating efficiencies by deploying a high-speed, in-plant CBRS network.

The aforementioned CBRS band and access to lower-cost carrier grade equipment enables small operators to gain exposure to 5G market opportunities in a low-risk way.

If President Biden’s infrastructure plan successfully prioritizes government-run and nonprofit organizations, managed services should be on the table as an opportunity for rural communication operators. The aforementioned organizations have limited experience in designing, building, and running, a telecom network. The high-cost nature of the unserved and underserved areas means that fixed wireless 5G play a role in some of the markets. Rural communication operators are well-positioned to help these grant-receiving organizations design and build 5G networks. They could also leverage their network infrastructure and experience to manage the day-to-day operations of the network.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022As Tier 1 operators build out the edge of their 5G networks into rural America, they need access to fiber and towers. It makes sense for Tier 1 operators to partner with rural operators who have such infrastructure already in place versus building their own towers/fiber networks. This is especially true in the current environment where access to equipment and labor is very tight.

The potential windfall of government broadband support represents opportunities for rural wireless operators by either expanding their existing networks or via managed services should government-run and/or non-profits receive priority funding. Longer-term, rural operators are well-positioned to offer fiber backhaul and tower leasing services to expanded 5G networks in rural America.

For more information, please email [email protected] or visit https://www.cobank.com.

Follow CoBank on Twitter @CoBank.

Follow Jeff on Twitter @Jeff_C_Johnston.