3 Concerns And 3 Recommendations

A Gordian Knot is a metaphor for both a problem solvable only with bold action, and an intractable problem or a complex, severe, and enduring, conflict. Do the current Digital Divide solutions create such a knot?

The $65 billion current infrastructure bill has now been passed into law to help solve The Digital Divide. There is additional federal funding coming from the RDOF phase auction completed in 2020 and a proposed phase 2, as well as state broadband funding available under the American Rescue Plan Act of 2021.

While the funding is critical, we must also explore 3 concerns related to how these funds will be best put to use — in terms of both the final product outcome and the process.

Concern #1: Product Outcome Performance And Sustainability

The broadband infrastructure resulting from this bill must be capable of propelling rural America for generations. As an example, the rural electrification bill of 1936 rejected calls for inferior solutions (such as funding small low voltage DC wind generators at each home to occasionally run a few lights and a single radio) and created high-quality sustainable infrastructure. The resulting grid has already served rural America for nearly a century, with ever increasing applications for electricity — applications never imagined in 1936.

Rural broadband infrastructure must have the same longevity. The growth of Internet use in rural areas over the past 20 years is apparent, from emails and early websites in 2001 to video conferencing and precision farming in 2021. The vision of the next 20 years is now becoming evident: augmented and virtual reality applications, including for employment, and autonomous vehicles and machinery with high-speed connections, precision farming… which will continue to expand and drive unprecedented digital demand. All these require high bandwidths in both directions. Even today, during peak periods of productivity and collaboration, upload needs exceed download needs.

How can we maximize the outcome of the infrastructure bill? While the broadband bill allows solutions down to 100/20 Mbps, it is of upmost importance that far higher quality symmetrical Internet be funded wherever possible to meet both current and future network demand. In almost all cases, rural home broadband infrastructure should be capable of eventually carrying many gigabits — in both directions. Optical fiber all the way to the end point is the only known medium capable of meeting this demand. If other solutions are allowed for extremely remote outliers, rigorous standards must be applied. There absolutely cannot be a call for the government to correct the problem of rural broadband again.

Concern #2: Process: Quality And Practicality Of The Award Phase

Without carefully crafted guidelines and timetables for the award phase, the implementation of the federal broadband infrastructure program could result in a program that does not select the most qualified construction and operation companies or access as much domestic labor and material supply as possible.

It takes time for government-funded programs to develop structure as well as to review, vet, and select, recipients. Past programs have taken 15-19 months from enactment to the announcement of initial awards. (See Figure 1.)

Most funding will be funneled to individual states for distribution. While this allows more local knowledge of true need, the states have varying degrees of experience in selecting and funding broadband projects.

How can we maximize the effectiveness of the award phase? First, enough time must be allowed for the allocation of funding. Second, various entities should step up to assist states with less experience, including both federal agencies and private entities such as industry associations and non-profits. At this writing, various groups such as the Fiber Broadband Association and Pew Charitable trusts are setting up consulting assistance for the states where needed.

Concern #3: Process: Quality and Practicality Of Construction Phase

Potential problems with the construction phase include both the materials supply chain and labor availability.

An obvious first question: is optical fiber supply a potential point of shortage in the United States? Based on everything we know, barring some unforeseen worldwide raw material shortage, the short answer appears to be that domestic optical fiber (the glass fibers) and optical fiber cable (multiple optical fibers in one jacket) will not likely be a significant and long-lasting point of shortage — even if the new federal broadband infrastructure investment is concentrated in a short build-out period.

Overall, US manufacturers of the glass optical fiber have done an excellent job in anticipating demand and keeping up with the curve. At present, RVA analysis of domestic fiber demand and capacity shows a headroom in US supply compared to US demand.

We believe this based on 3 crosschecks: 1) directly modeling current supply and demand, 2) asking manufacturers directly, and 3) most definitively, reviewing export records. US manufacturers of optical fiber currently export most of their overage capacity. According to data from the Global Trade Information Services, net of imports, there are currently about 37 million optical fiber miles exported annually. (See Figure 2.)

This current headroom, if turned to meet domestic demand, should handle all the increased demand from both the Rural Digital Opportunity Fund and the federal broadband infrastructure fundings — an estimated incremental 27 million miles of optical fiber annually, even if a short construction window is maintained.

Turning to fiber cable (fibers in a jacket), there is a verified short-term availability concern. There has been a large domestic surge in demand for cable with some limitations in production. The supply-side problem relates primarily to the capacity of current cable making plants, as well as the availability of some resins and metals (for cable protection) used in cabling. Fortunately, raw material problems appear to be shortterm, and new cable manufacturing capacity can be installed in less than a year.

Semiconductors for electronics are also a significant current concern as reported by US Telecom to the FCC. This concern may too be short-lived. In June 2021, the U.S. Senate approved the U.S. Innovation and Competition Act (USICA) which allocated $52 billion for domestic semiconductor manufacturing. We believe most supply chain disruptions will be resolved and the free market will drive suppliers to respond to the incremental demand caused by any existing or proposed broadband infrastructure programs.

Labor is perhaps the most difficult concern. Without carefully crafted guidelines and sufficient timetables for the construction phase of the program, the construction process could result in excessive competition for labor and resources in short term — impacting both availability and cost. Concerns about finding qualified labor for construction and, specifically, telecom construction, is based on actual data.

- Reviewing construction workers overall, the 2020 Construction Hiring and Business Outlook report by the Associated General Contractors of America found that 76% of construction businesses with open positions are having a difficult time finding qualified skilled labor.

- In May 2021, Veriforce reported on a survey of telecom executives who were said to collectively employ more than 240,000 contractors. According to the study, the top challenge facing telecom companies is currently skilled workforce availability, with 86% of company executives naming skilled labor as the top challenge facing the industry.

- The availability of aerial pole and line workers may currently be the highest point of labor availability stress. In 2020, Commissioner Brendan Carr of the Federal Communications Commission, noted in interviews that there were at least 20,000 available jobs for tower climbers to install equipment. Based on RVA interviews, other current needs identified included horizontal directional drill operators and fiber splicers. Brookings likewise noted the need for 18,000 line installers.

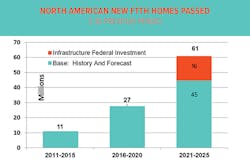

Based on a January 2021 FTTH forecast from RVA LLC predicting the likely deployment from more than 1,200 large and small private and municipal FTTH providers in the US, the period 2021-2025 will likely show record deployment even before considering new federal rural investment programs. The number of homes-passed in the period is currently expected to grow by 45 million, 1.7 times over the previous 5-year period.

If the current infrastructure bill and other federal broadband investment programs were all limited to the period of 2021-2025, large and perhaps unworkable labor projections appear. The new infrastructure bill will add an estimated 16 million homes passed to the forecast and, when combined with the base forecast of 45 million homes passed (which includes other government programs) would bring the total to 61 million homes in the 5-year period, representing an increase of 2.3 times the previous 5-year period.

More homes will be passed in the next 5 years than in all of FTTH history combined.

This will put us well on the way to meeting the goal of connecting all Americans to high-quality broadband service. (See Figure 3.)

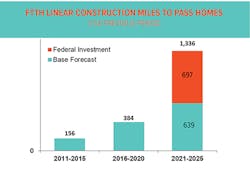

Another important aspect of federal rural broadband funding is that, by definition, nearly all funding will go to less dense areas, meaning the average distance between each home increases versus suburban deployment. Comparing an estimated average 230 linear feet of cable required to pass each qualifying rural home, with 75 linear feet required for each suburban or urban home, suggests the increase in linear feet of new rural infrastructure would multiply the scale of build-out by 3.5 times the previous 5 years. The line lengths have a strong correlation to the amount of labor required. Such a large increase in fiber line installation represents a profound and probably unworkable stress on labor supply. (See Figure 4.)

Meanwhile, underlying activity for other telecom work, especially 5G, is also expanding, placing further stress on employment resources. Closer and more frequent 5G towers are primarily served with fiber all the way to the radio head. Twelve (12) leading telecom industry trade associations wrote a letter in January 2021 to President Biden urging more workforce development. It was projected that 5G alone would create 3 million direct and indirect jobs by 2025. A letter from the 5G industry concluded "While the jobs are there, our American workforce is not currently ready to fill them."

How can we maximize the effectiveness of the construction phase given labor concerns?

Despite the urgent need for better rural broadband, it appears that, if possible, extending the construction phase to, say, 8 years beyond the award phases to flatten the curve would be optimum. This longer period would greatly increase the likelihood of being able to sufficiently recruit, develop, train, and certify, the necessary workforce, and to maintain the quality and sustainability of work completed.

Though less of a concern than labor, a longer timeline also decreases the likelihood of intermittent material supply shortages. This also ensures a greater percentage of products will come from domestic supply chains and domestic manufacturing, furthering government objectives to stimulate American jobs.

But with or without a longer construction phase, strong and intentional efforts and programs from both industry and government are needed to automate processes wherever possible, and to recruit, train, and certify more workers.

Assistance in this effort may come from community colleges, technical colleges, workforce development agencies, industry, and government at all levels. More apprenticeship or internship programs must be developed that blend field work, technical training, and college preparation, or progress, if desired, using novel partnerships between industry and educators. As an example, the Fiber Broadband Association is currently setting up labor training and certification programs in several states. ISE is expanding its professional development programs.

Conclusion

- The final government-funded infrastructure must be capable of propelling rural America for generations — primarily with the capability of at least Gigabit speeds in both directions (symmetrical) through optical fiber.

- US government funding should support US jobs and US-made materials whenever possible.

- To minimize the stress on labor and materials, and ensure an effective and efficient process, we suggest an 8-year construction window if possible — to balance the urgency of need with the quality of result. Material constraints, such as semiconductor shortages and sufficient fiber capacity, are viewed as short-term problems and will likely resolve, but require diligence. The labor constraint is more concerning and will also require concentrated efforts from both the private and public sectors — even given a longer time horizon.

The bottom line is this: the infrastructure bill creates the opportunity to greatly decrease The Digital Divide — especially the availably component. But the actions taken today must not create a framework for a new Digital Divide tomorrow!

Resources And Notes

This adaptation is created from the white paper Maximizing the Impact of U.S. Public Investment in Rural Broadband, July 2021. The complete text and sources can be found and downloaded at: www.rvallc.com/smart-city-5g-digital-divide-reports.

For more information, email [email protected] or visit www.RVALLC.com. Follow Michael on Twitter @MichaelCRender and LinkedIn: https://www.linkedin.com/in/michael-render-1597015/.