Latest from 5G/6G & Fixed Wireless Access/Mobile Evolution

How Will They Impact Your Network?

Connected products are developing at a rapid pace across a number of geographic regions and countries, greatly impacting the market for new consumer applications and services. The consumer electronics (CE) industry has migrated from producing and distributing hardware to distributing OTT content, providing intelligent home function and control services, programming and licensing software, and leveraging advertising models to connect consumers with desired products and services.

The average US broadband household now has 8.3 connected CE devices, compared to 8.4 in 2018. This slight decline in ownership is mainly due to decreasing ownership of video entertainment products such as personal video recorders, Blu-ray players, and gaming consoles. Meanwhile, connected audio devices, led by smart speakers, have seen enormous growth.

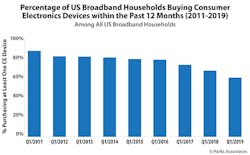

Overall, CE purchase intentions for 2019 are slightly higher than 2018, but still below previous years. Consumer purchase intentions have increased 2 percentage points from Q1 2018 to Q1 2019, rising from 52% of US broadband households intending to purchase at least 1 consumer electronics product in the next 12 months to 54%. The greatest increase was in consumers intending to purchase smart TVs — purchase intention rates rose from 16% of US broadband households to 21% — a rise of 5 percentage points. (See Figure 1.)

Figure 1. Parks Associates: Consumer Purchase Patterns

Trends and Market Developments

The latest trends and market developments in connected CE and platforms include the emergence of 5G smartphones, the rapid adoption of smart speakers and particularly smart displays, and the growing convergence of connected devices using voice as a platform.

Smart Speaker and Smart Display Adoption

As of Q2 2019, over 36% of US broadband households own at least 1 smart speaker and 16% own at least 1 smart display. Adoption of smart speakers with personal assistants such as the Amazon Echo and Google Home has tripled since 2016, and adoption of smart displays has more than quadrupled since 2017. Consumers of all age levels and levels of technological adeptness are purchasing these products — Parks Associates consumer surveys find that almost one quarter of heads of US broadband households age 65 and older owns at least 1 smart speaker or display. This number rises to roughly half among millennial heads of households.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022As these devices proliferate, platform players Amazon and Google are leveraging their software ecosystems to drive services revenue through subscriptions and in-skill purchases. Ownership of smart speakers is particularly tied to the use of music streaming services, with smart speaker owners using these services at over twice the rate of non-owners. (See Figure 2.)

Figure 2. Smart Speaker and Smart Display Adoption (Q2/19)

The rise in smart speakers comes alongside a trend of flagship smartphones losing the headphone jack. Consumers must now decide as to whether or not they should purchase new headphones or transition their music listening to a new device. The only unaffected products are those that are not typically used to listen to music, such as those that interface to televisions.

5G Smartphones

During 2018, consumer-reported smartphone purchases stabilized at between 20-21% of US broadband households, after sharply dropping from 27% of US broadband households reporting a smartphone purchase in 2017. This is on par with current self-reported consumer purchase rates for laptops.

To revitalize smartphone purchases, smartphone makers have begun launching their first-generation 5G smartphones on a limited basis, and signs point to a widespread launch of these phones in 2020-2021. While the emergence of 5G may help to revitalize interest in new smartphone models, a high percentage of consumers lack interest in 5G use cases such as on-the-go virtual and augmented reality. Without strong new use cases to drive 5G interest and incentivize smartphone upgrades, it is likely that smartphone replacement cycles will continue to lengthen.

Parks Associates expects the smartphone market to become the next PC market, with a race to the bottom on prices, and a focus on innovation in form factors driving interest in upgrades.

Convergence of CE and Smart Home With Voice

An increasing number of products are gaining voice control functionality as well as integration with voice assistants. As a result, the smart home and connected consumer electronics spaces are converging, with everything from Wi-Fi printers to robotic vacuums now integrated with Amazon Alexa and Google Assistant.

Recognizing the opportunity to utilize this technology to appeal to a larger consumer base, TV manufacturers such as Samsung and Sony are now integrating voice control into their smart TVs via a mix of voice remotes, support for Alexa and Google Assistant smart speaker ecosystems, and in select higher-tier models via embedded microphones. Hisense and Insignia are also now offering voice-control in their mid-tier (and some value) TV models and expect to see unit sales more than triple by 2022.

Innovations

Recent innovations in the connected CE and platform space include advancements in augmented reality, an evolving digital subscription-based market, and the expansion of voice assistant technology in headphones.

Augmented Reality and the Evolution of the Smartphone

In order to combat falling sales, smartphone makers are turning to new and innovative technologies and form factors in an effort to drive up consumer interest. Leaders are adopting new user experiences such as augmented reality as well as new foldable form factors. While smartphone augmented reality has existed in various forms for over a decade, supported by third-party software development kits (SDKs) like Wikitude, Vuforia, DeepAR, and ARToolKit, more recently, with the launch of Apple’s ARKit and Google’s ARCore, smartphones and tablets offer native augmented reality support. New advances in smartphone hardware — such as 3D sensing cameras and AI chips — enable developers to build more powerful AR experiences using devices many consumers and

businesses already own.

Parks Associates tested consumer familiarity with various augmented reality technologies and devices and found that only 12% of heads of US broadband households consider themselves to be "familiar" with any one tested device or technology. (See Figure 3.)

Figure 3.

With awareness of augmented reality so low among consumers, companies will need to do more to drive development of this market if they plan on using it to increase smartphone sales. Two things they can leverage are:

1. Evolution of Subscription Service Business Model

An increasing number of hardware devices are tied to additional subscription services. These new device types range from smart speakers to connected exercise equipment to streaming media players. Smart speaker growth is tied to increases in digital media subscriptions, in particular increasing subscription and use of streaming music services, podcasts, and audiobooks.

In the exercise world, companies such as Flywheel and Peloton are pioneering a new business model combining exercise equipment ownership and subscription to online fitness classes. Parks Associates consumer surveys reveal that 8% of US broadband households own at least 1 piece of fitness equipment — such as a treadmill, elliptical, rowing machine, exercise bike, or bike trainer — with built-in app support.

Streaming media player makers have launched new device functionality, allowing users to sign up for over-the-top (OTT) video services directly on the player itself via programs such as Amazon Channels, Roku Channels, and Apple TV Channels. The service typically splits a percentage of the recurring revenue with the device maker, and the device maker showcases the service in the streaming media player’s UX and helps to drive new sign-ups and subscriptions. OTT services are eager to engage with this new business model — as of Q1 2019, Parks Associates estimates that almost 30% of US OTT services are partnered with Amazon Channels.

2. Integration of Smart Assistants and Headphones

Our consumer survey data reveals that as of Q1 2019, roughly 10% of US broadband households own at least 1 pair of headphones with an integrated smart assistant, with Apple’s AirPods the leading brand. According to information released by Apple during the company’s quarterly earning calls, sales of its wearables lineup — including AirPods — are the strongest growing product category, with product sales regularly growing by 50% or more year-over-year.

Smart assistant access on headphones and earbuds works similarly to smart assistant access elsewhere. Users are able to access functions such as voice calling, music control, volume control, directions, checking the weather, and setting timers, simply by either saying the assistant’s wakeword or pushing a button and then making a request via voice. A significant percentage of headsets lack wakeword support: wearers must first press a button to wake up the assistant. New chips from silicon vendors are on their way that will allow more headset makers to include this functionality.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

Consumers are consolidating their entertainment around a handful of high-utility video products, and removing those that are no longer of value. As companies continue to develop and innovate in the connected CE products and services space, the most successful players will take advantage of growth opportunities to drive adoption.