Latest from 5G/6G & Fixed Wireless Access/Mobile Evolution

Co-authored by Greg Najjar, Mark Reynolds, Don Bach, and Luke Lucas —

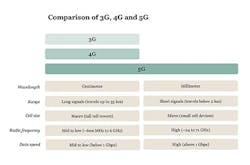

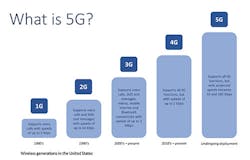

Each generation of wireless technology has revolutionized how people communicate and consume content. Second-generation cellular networks, for example, allowed people to text one another. Third-generation

networks enabled far greater mobile broadband data. Fourth-generation networks enabled mobile video usage without frustrating delays. Fifth-generation cellular networks are expected to enable another revolution, transforming how people and machines communicate and even how industries do business.

5G network deployments are also expected to provide significant economic and efficiency gains in the markets where they are deployed. Smart-factory and smart-city applications, autonomous vehicles and machines, and telemedicine applications are just a few of the examples where 5G technology is expected to impact a range of industries.

As such, 5G cellular networks will bring with it a paradox once it is deployed. Even as 5G networks will bring more spectrum to market, the massive amounts of new connections that will be available could overwhelm networks once billions of diverse devices connect to the 5G networks. So even as new spectrum comes to market, operators will continue to need to use offloading techniques to keep the macrocellular network operating efficiently.

Already, Wi-Fi networks are used to help alleviate some of this data congestion in hopes of providing a seamless customer experience both outdoors and indoors. That practice will continue as wireless demand increases, driven not only by people but also machines that use wireless technology to communicate with each other. The ability to leverage a variety of licensed and unlicensed spectrum across multiple frequencies using various technologies, along with techniques to increase overall transmission bandwidth, remains an essential part of the answer to meeting the demand for mobile connectivity.

The Case for Offloading

The amount of mobile data traffic on cellular networks is skyrocketing, and data usage is expected to continue increasing for the foreseeable future. Americans used a record 15.7 trillion megabytes of mobile data in 2017, nearly quadrupling since 2014. Service providers are looking for ways to relieve congestion from data traffic by moving some of it onto local, in-building networks while maintaining the quality customers expect from the overarching cellular network.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022For service providers, offloading data traffic frees network capacity while continuing to provide the level of service their customers expect. Retailers, businesses and landlords find value in facilitating data traffic offload by providing their patrons and residents the connectivity they need, where and when they need it. People expect ubiquitous wireless connectivity everywhere they are, and buildings without mobile connectivity may be less attractive to enterprises and tenants.

Offloading allows customers to make and receive calls and texts over Wi-Fi or other local connections. Often the handover to a Wi-Fi network is seamless and customers aren’t even aware they are making a Wi-Fi call. Indoor, offloaded networks benefit customers by providing a seamless, out-of-the-box experience using their existing phone and phone number, and extending connectivity into areas where cellular and public-safety networks often don’t reach. Future improvements in Wi-Fi calling will provide a seamless handover between available Wi-Fi and LTE networks along with high-quality voice and next-generation calling features.

Technology Roadmap for Service Providers

Several technologies exist or are emerging that can facilitate offloading cellular traffic onto small, localized networks, with the primary candidates being Wi-Fi, Citizens Broadband Radio Service (CBRS), and 5G. Each provides different considerations for service providers.

Wi-Fi

Cellular operators have long embraced Wi-Fi as an offload strategy, and several major carriers are supporting the Wi-Fi Alliance’s Passpoint service, which automatically moves users to a Wi-Fi service when available. Visitors from different nations whose cellular providers have no roaming agreements or technology compatibility with US terrestrial networks already use Voice over Wi-Fi when coming into the US to avoid expensive roaming fees. While some automated soft handovers are available today, as LTE-A releases 16, 17, and 18 roll out and IP-based hard handovers become possible, the seamless use of indigenous Wi-Fi networks for stand-alone and aggregated sessions will enable BYOD users with capped data plans to roam onto any open, available networks.

The current number of Wi-Fi access points deployed for wireline backhaul delivery is not robust enough for wireless service providers to deploy current 4G LTE wireless services, and not ubiquitous enough in rural areas. The lack of fiber and Gigabit ethernet availability from a population and geographic perspective is one side of the shortage; the other is that there is not enough bandwidth delivered to the available access points.

However, in most places where backhaul is available and in use to support Wi-Fi services, more access points can be added easily and inexpensively in the near term. In the longer term, the number of wireline access points and the maximum amount of bandwidth deliverable to each of them will have to increase to keep pace with the amount of data consumed on the network. For example, the University of New Mexico has more than 400 deployed access points with 1 GB to each port and from 10 GB to 40 GB for the backbone.

CBRS

Citizens Broadband Radio Service (CBRS) offers cost-effective LTE solutions for both indoor and outdoor applications, and network operators are looking to use CBRS as another method to offload cellular data traffic. As cellular carriers upgrade and expand their networks for 5G, they are also looking for new ways to offload capacity. There are various technologies and methods for capacity offloading, such as Wi-Fi, small-cell densification and carrier aggregation, and using CBRS technology is being planned as well. Because it is an LTE-based technology, CBRS offers network operators a high level of network quality, performance and flexibility compared with Wi-Fi for network offloading. For example, carriers with PAL licenses will be able to use CBRS in 10-megahertz channels, allowing network operators to use carrier aggregation to increase network capacity as well as improve data speeds.

Recent changes by the FCC have increased carrier confidence in their ability to deploy CBRS effectively, increasing the level of investment and usage expected. CBRS offers carriers roughly 150 megahertz of spectrum for LTE capacity. It has advantages over Wi-Fi related to security, emergency calling, SMS support and roaming. It also can be an option if small-cell deployments are not practical. In addition, CBRS has better RF propagation than other 5G technologies that are expected to operate in the 5 GHz (and higher) range.

Wireless service providers considering CBRS will find some key benefits for today’s networks, including enhanced capacity for current networks using LTE for 4G services at different frequency bands. The 3.5 GHz band can also be used in transition plans to 5G networks. The CBRS structure also might transform the approach of managing frequency bands to enable 5G radios to work in a shared-spectrum environment, an approach backed by the 3GPP. The CBRS band could also be used to synchronize services with international operators, enhancing international roaming and providing better coverage for subscribers.

5G

5G will provide a dramatic shift in network architecture for wireless service providers. The recent acquisition of high-frequency bands between 1 GHz and 3 GHz will result in smaller wavelength propagation characteristics. This necessitates network designs that are smaller in coverage footprint but will also help support a very dense network that will be low powered and achieve very low noise in the 5G environment.

RF design engineering efforts will require a hub-spoke concept that moves centralized processing into areas closer to the antenna. Each spoke will align with each deployed antenna location. This concept can also load balance processing into the distribution network as signals move closer to the antenna. This design approach will yield a higher performing 5G network but also requires a more complex architecture with active network components closer to the antenna — or the network’s edge.

Another key requirement for 5G networks is network densification, where concentrated antenna footprints will support high bandwidth and low latency. The hub-spoke design approach will help achieve densification in an efficient manner and produce a high-quality signal allowing mobile devices to be responsive. The ability to detect mobile device usage, especially in high-demand, constant transmit-and-receive environments, will allow wireless service providers to shift network capacity to those areas immediately. Virtualized network elements and edge processing can be utilized to support this high-demand 5G architecture.

With this type of dense network architecture, there will be a heavy utilization of fiber and structured cabling solution assets to support connectivity to antenna locations. This is necessary to transport signals to core-network processing and edge-computing devices, and to help achieve high-quality network performance in low-powered, low-latency environments.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

Wanted: Network Professionals

Third-party operators are well positioned to secure access to key customer locations and to help wireless service providers with connectivity. These operators will become instrumental to the 5G ecosystem as they provide ancillary support for network infrastructure and services to the wireless service provider.

As the 5G network evolves and the network deployment strategy to densify signals becomes pervasive, the need to utilize qualified professionals becomes even more essential. RF integration companies will be heavily utilized to provide services for all areas of installation, monitoring, and commissioning of 5G networks. With more active components introduced into the 5G network and edge-computing devices used for 5G service delivery, there will be a high demand for skilled field resources. Intelligent network resources will require training for engineers and technicians on new platforms to help optimize, monitor, and maintain, new 5G networks.

[toggle title=”CBRS Is Whaaaat?” load=”hide”]CBRS Is Whaaaat?

In 2015, the Federal Communications Commission (FCC) established a new Citizens Broadband Radio Service (CBRS) band for shared wireless broadband use by authorizing the 3.5 GHz spectrum band (3550 MHz to 3700 MHz) which had previously been allocated exclusively for the U.S. Navy and other Department of Defense (DoD) entities. CBRS uses TD-LTE and supports voice, text, and high-speed data technologies much like LTE does on other cellular frequency bands. However, the FCC has decided to allocate CBRS spectrum to owners (and users) in a slightly different method than traditional cellular — where operators lease large holdings covering miles of various geography — and Wi-Fi, which is completely unlicensed. Instead, the spectrum will be assigned and used individually by various users. When the spectrum is not being used, it may be "recycled" and assigned to different users.

The 150 megahertz of CBRS shared spectrum falls into 3 user categories: incumbents (DoD); priority access licenses (PAL); and general access licenses (GAL). There are several services that assist in coordinating access to this spectrum. Spectrum Access System (SAS) is a cloud-based service that coordinates access to the shared spectrum, enforcing priorities and modeling the RF environment. Environmental Sensing Capability (ESC) incorporates environmental sensors deployed in strategic locations near naval stations, mostly along coastal regions, to detect incumbent activities.

Incumbents, including U.S. Naval Radar and DoD personnel, get permanent priority as well as site-specific protection for registered sites. Priority Access License (PAL) holders can pay a fee to request 10-megahertz licenses on a county-by-county basis for 10 years. Up to seven 10-megahertz licenses can be awarded in one county. General Authorized Access (GAA) encompasses the rest of the spectrum, which will be open to GAA use, and coexistence issues will be determined by SAS providers for spectrum allocation.

CBRS offers a variety of potential advantages to stakeholders:

• It can allow nontraditional carriers to enter the wireless market.

• The propagation characteristics of the 3.5 GHz spectrum allow it to be deployed similarly to Wi-Fi networks and installed in a floor-by-floor fashion inside of buildings.

• LTE’s superior quality, performance, and security, bodes well to transition Wi-Fi routers into CBRS-compatible gateways.

• CBRS is supported by a variety of stakeholders, including the CBRS Alliance, the Wireless Innovation Forum, Software as a Service vendors, radio and handset OEMs, wireless carriers and cable operators, mobile virtual network operators, and neutral-host providers.[/toggle]

For more information, please email [email protected] or visit https://wia.org. Follow the WIA on Twitter @WIAorg.