Seven Steps for Conducting a BEAD Workforce Gap Analysis

BEAD sets out to bring high-speed broadband Internet to the millions of Americans that are currently unserved and underserved—estimated to be around 13.1 million locations based on the data in the FCC Broadband Map.

Building this new infrastructure will be a multi-year endeavor, unlike anything seen before. According to the government’s calculations, 150,000 telecom jobs will be created by BEAD, while research by the Fiber Broadband Association (FBA) estimates the industry will need over 205,000 new jobs in the next five years.

Many different job roles are needed to construct, operate, and maintain the new networks built through BEAD funding—and these will be required in every state. However, the telecom workforce has been shrinking for years and the industry lacks an efficient pipeline to bring in new workers.

Considering the above, there is serious risk that there will not be enough feet on the ground to deliver the new networks. For the states, insufficient availability of high-skilled labor will result in workforce bottlenecks, leading ultimately to delayed or failed projects.

Workforce availability is not a new challenge to the telecommunications industry. To put it into numbers, the telecommunications workforce has declined every year over the past decade, down 23% from 854,200 in January 2013 to a projected 656,700 workers in January 2023. While the U.S. Government Accountability Office (GAO) finds there are mixed indicators of an industry-wide labor shortage, the Bureau of Labor Statistics (BLS) finds the average turnover to be 56.9% for construction and 54.9% for utilities.

Workforce development is a broad topic area with many components and, when it comes to BEAD, it’s a large undertaking that’s ambitious in nature. A comprehensive strategy necessitates engagement from more than just the telecommunications industry—construction, secondary and post-secondary education, community partners/organizations, and other state agencies—are needed to shape and support state initiatives.

This comprehensive strategy must include five subsections:

- Workforce Development Goals: Aligning the strategy with the BEAD program.

- Creating a Dedicated Team: Establishing a core team to lead the workforce research, analysis, and strategy development.

- Conducting a Workforce Gap Analysis: Estimating the gap between labor needed for BEAD deployment and projected available labor in the state.

- Surveying State Resources: Engaging stakeholders to gather their input and understand the resources available for workforce development in the state.

- Defining the Workforce Development Strategy: Synthesizing findings from stakeholder discussions and create a strategy that meets the Five-Year Action Plan requirements.

This article summarizes one key part of the five subsections—conducting a Workforce Gap Analysis.

The Seven-Step Program

The first step in scoping the “what, where, and when” of workforce needs is to document current and expected capacity. To quantify this workforce shortfall, states will need to conduct a workforce gap analysis. This analysis will provide vital insight into the size and shape of the existing workforce and identify the nature and scale of upcoming workforce supply risks. The output of this activity provides the foundation and context on which to build the workforce development strategy.

A workforce gap analysis will follow seven steps:

1. Assemble the analysis team: The team should include data analyst expertise and experience with job classifications systems, statistics, and/or quantitative research on labor markets.

2. Survey employers to understand current workforce composition: Gather data from employers within the state on the job roles needed for fiber broadband deployment (e.g., fiber splicers, surveyors, construction managers, etc.), number of employees, age profile by role, and historical recruitment and attrition rates. Map out the workforce to understand locations (e.g., rural geographies) where labor is scarce.

3. Define which occupations are in scope: Select job classification system/approach to use in scoping roles for the gap analysis. At this stage, it’s imperative to be aware of all jobs involved in a deployment project, as a worker shortage along any part of the process can cause delivery delays.

- While not all telecom job roles fit cleanly into the BLS Standard Occupational Classification (SOC), there is extensive and readily accessible time-series data for these occupational codes, making this system an easy option to use.

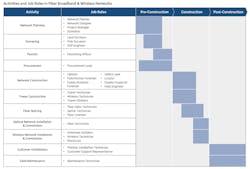

- States will then need to select occupational titles for inclusion in the analysis based on the chosen classification system. For simplicity, states may choose to focus on the top occupations per deployment phase (pre-construction, construction, post-construction) or other group mechanisms. (See Figure 1.)

4. Quantify projected employment under current hiring/training: Forecast employment by job role over the BEAD Program timeline. This will provide a baseline workforce—essentially the workforce available if there is no intervention to increase the labor pool.

- Apply anticipated macro-level employment shifts to industry patterns on an annual basis; industry patterns calculated annually as: current workforce + rate of new hires into industry – retirees – job leavers.

5. Quantify workforce needs: Forecast the number of jobs per year needed for steady-state business as usual, BEAD-sponsored projects, and any state funded programs. There are several methodologies that can be applied, each with its own strengths and limitations. SBOs should connect with other state agencies (e.g., Department of Labor) to understand what data is already collected at the state level and whether existing methodologies can be applied to the broadband industry. Potential approaches include:

- Input-based: Calculate the number of new jobs needed based on ongoing and anticipated private and public funding (including matching funds), using employer data about job creation from historical investments as a baseline.

- Output-based: Divide states into regions and calculate using regional estimates for new fiber miles generated by BEAD and industry data on fiber miles that can be laid per person, repeated for all regions in the state. Analysis should be done at regional level to loop in region-specific ISPs and account for geographical differences that impact fiber pacing.

- Employment Share-based: Calculate by weighing occupation employment shares by estimated industry weights found by mapping estimated expansion cost structure of a project into industry shares of total output created by the spending.

6. Calculate the gap: The workforce gap is the difference between the estimated levels of employment under current conditions (Step 4) and expected number of jobs that will be needed (Step 5). This can be done annually or cumulatively, based on the approach taken in previous steps.

7. Validate the results and expand on findings: Review findings with employers (service providers, construction firms, contractors, etc.) for validation. These companies can check the outputs based on firsthand experience; their inputs should be used as context for interpreting the analysis results.

Following the workforce gap analysis, states should be able to answer the following:

- How many total positions will be needed for BEAD deployment?

- Which roles face the biggest shortages in the short, medium, and long terms? Do any of these roles require specialized skills?

- Are there any bottlenecks at certain levels/roles?

- How will retention and retirement impact the workforce?

- How much funding will be needed to provide sufficient training resources?

Remember, this exercise is one of five in a comprehensive workforce development plan. While the examination may take some time and energy, the results will help address the people, skills, and plan your State needs to deploy BEAD funds effectively and efficiently.

About the Author

Deborah Kish

VP of Research & Workforce Development, Fiber Broadband Association

Deborah Kish is Vice President of Research and Workforce Development for the Fiber Broadband Association (FBA). In her role, she is leading FBA’s research initiatives as well as serving as team lead building “OpTIC Path™” (Optical Telecom Installer Certification Path), the association’s fiber optic technician certification program. Prior to joining FBA’s team, she spent over 20 years as an analyst at Gartner covering broadband, telecom switching, signaling and security topics advising thousands of service provider and vendor clients about product and service strategy. To learn more, visit the FBA at https://fiberbroadband.org/. Follow Deborah on Twitter @deborah_kish. Follow the FBA on Twitter @fiberbroadband, LinkedIn: https://www.linkedin.com/company/fiber-broadband-association/, and YouTube: https://www.youtube.com/channel/UCDbakO-985kRbEXJtYz90-Q.