Latest from Home

3 Backup Power Trends to Consider —

Heraclitus, a Greek philosopher, is quoted as saying, "Change is the only constant in life." It was true in 500 BCE and it remains true today. Perhaps one of the fastest industries to pursue change is telecom, always in pursuit of faster data covering more areas of the country and the world.

Three trends point to areas telecom carriers are focused on as we move into the latter half of the 2010s:

Trend #1: Efficiency improvements through smaller sites and lower power draws.

Trend #2: The Industrial Internet of Things (IIoT).

Trend #3: Increased focus on sustainability.

While these trends affect many aspects of network operations, let us dive into each of them to understand what they are, and how they impact the types of backup power that are most applicable to network operations. (Like most situations in life, it’s entirely possible the "best" choice is going to change over the next several years.)

TREND #1

Improving Efficiency Through Smaller Sites and Lower Power Draws

The telecommunications market is demanding an increasingly efficient operations model: one that decreases energy consumption, reduces remote site footprint, and lowers maintenance requirements while increasing sustainability. According to an April 2017 article in AGL magazine, US wireless carriers collectively spent an estimated 9% less in capital expenditures in 2016 than they did in 2015, with a trend toward smaller, less costly wireless sites.1

The traditional macro site model featured high-powered cell sites with multiple technologies from multiple specialty vendors. Large shelters were needed to house multiple generations of radio technology as well as future hardware growth, which also necessitated large DC power plants to serve site loads and AC generators to meet peak needs from HVAC units for cooling and DC power plant recharging.

As the architectural and operating efficiencies of network equipment have improved with the latest wide-scale deployment of 4G LTE technologies, the power requirements to support these networks have decreased dramatically.

• The improvements in power amplifier efficiency and the reduction in cable loss provided by a remote radio head architecture have resulted in reduced overall power consumption at the base station.

• New software defined networks (SDNs) also allow operators to upgrade technologies without costly hardware additions or replacements.

• Additionally, the improvement in environmental hardening of formerly sensitive base station and backhaul equipment, as well as the introduction of high temperature battery technology, have made it possible to eliminate the need for active air conditioning in favor of more reliable and more power-efficient DC heat exchanger solutions.

• Having all critical site equipment DC-powered eliminates multiple points of failure, increasing reliability and opening up the network to various backup power options, including hydrogen fuel cells.

The new macro 4G LTE site model features increased site counts for better coverage, but a significantly smaller site footprint due to newfound efficiencies in communications and support equipment. At a growing number of locations, primary power, backup, and communications equipment are being combined into integrated cabinet solutions, leading to savings in both upfront capital and ongoing maintenance costs. Additionally, the smaller power requirements allow operators to utilize more targeted power strategies, which include both primary grid power and backup power designed to meet the lower overall requirements of the site.

TREND #2

Industrial Internet of Things (IIoT)

At the rate the Internet of Things space is progressing, it’s not going to be long until our daily lives consist of a series of interlocking IoT-enabled services. Whether it’s household items like Amazon’s Echo and Google’s Nest thermostat, or the connected technology powering newer vehicles, already millions of households are experiencing this shift from sunrise to sunset. These smart sensors proliferating within our communities often rely on carrier networks to deliver their magic.

Carriers, too, are increasingly relying on IIoT for network operation tasks that include remote site monitoring in order to decrease the maintenance requirements for each location and, thus, operational budgets. In fact, one of the big advantages that IIoT-enabled services are providing carriers is the ability to increase network reliability through IoT-managed deployment of solar, wind, and fuel cell power solutions, via constant and comprehensive monitoring.2 Specifically, with fuel cells the IIoT enables carriers to stay ahead of hydrogen refueling needs and operational situations that threaten network functionality, ensuring robust reliability in their operations.

TREND #3

Increased Focus on Sustainability

Telco pacesetters continue to increase their use of clean energy for a number of reasons including economic advantage, commitment to reducing climate change, lowering their operations energy footprint, and staking a leadership position in the industry.3

In the last few years, both AT&T4 and Verizon5 have invested in clean energy in a big way through installations of solar cells6 and fuel cells. These sustainable solutions are being used to power corporate offices, call centers, and data centers, as well as cell towers.

Of the perhaps 4,000 fuel cells currently installed within domestic telecom networks, the vast majority provide zero-emissions backup power for wireless base stations. Fuel cells in this environment provide improved reliability, operational savings, and reduced reporting and spill mitigation requirements, as well as helping operators meet their sustainability goals.

Backup Power Options for Network Carriers

Carriers have multiple options for backup power, and this is a topic that has been discussed many times over the years. It comes down to 3 options: traditional batteries, combustion generators, and hydrogen fuel cells. While renewable solar and wind power are being used for off-grid primary power, they have not proven best as backup power solutions and will not be discussed here.

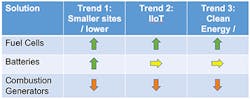

To see how fuel cells, batteries, and generators stack up against the 3 trends discussed above, please see Figure 1.

Figure 1. Backup power solution strength relative to current trends in telecom.

OPTION A: Fuel Cells

Cost-effective hydrogen fuel cells provide zero-emission power without combustion. The by-products are water vapor and heat, making them a clean technology that can be used even in environmentally-sensitive areas. Hydrogen storage and refueling offerings allow the system to run continuously as long as needed for extended outages. Based on technology available today, customer sites can be provisioned with fuel for days or months of runtime.

Fuel cell manufacturers offer a variety of robust products with very small to large power outputs to help harden the network against grid service interruption. They provide the operator with improved reliability and reduced greenhouse gas emissions while helping operators meet corporate sustainability goals. For these applications, fuel cells offer third-party verified reliability of 99.6%, compared to up to 88% for diesel generators7 and significantly lower maintenance requirements.

As carriers have lowered their power requirements with the adoption of 4G LTE networks, they have begun to adopt new space-saving solutions, including integrated communications and power cabinets that save up to 87% of footprint compared to a traditional shelter and generator solution. Southern Linc is currently installing several hundred of these smaller cabinets in its 4G LTE advanced network. (See sidebar: Southern Linc Is Powering Possibilities).

[toggle title=”Southern Linc Is Powering Possibilities” load=”hide”]

Southern Linc, a subsidiary of Southern Company, provides wireless communications to Alabama Power, Georgia Power, Gulf Power, and Mississippi Power, as well as to a wide range of government and business organizations within their 127,000-square-mile coverage area. Southern Linc is currently constructing a new 4G LTE Advanced network, requiring the installation of more than 1,300 eNB communication nodes.

The company’s 4G LTE Advanced network is designed to be extremely reliable with redundancies and hardening incorporated into multiple aspects of the network. The network will provide communications coverage for the service territories of their electric utilities, and is designed to provide mission-critical data and push-to-talk communications for day-to-day operations and for service restoration following emergencies. Specifically, their affiliates plan to use the new LTE network for applications such as distribution and transmission SCADA, AMI backhaul, and commercial and industrial metering backhaul. Commercial business and government customers who value the mission critical nature of the LTE network will also have the opportunity to use this network for voice and data communications.

Network construction has utilized a combination of existing and new tower locations to provide a footprint similar to the company’s current wireless network for installation of eNB nodes. While existing locations are already equipped with shelter facilities and backup power generators, new sites are not. Since LTE eNB equipment is smaller, more power efficient and does not require air conditioning, a large shelter is not required at new LTE sites. Because of these new factors and the time, resources, and cost, to maintain the current generator fleet, their teams explored other options for backup power. This exploration led to an eventual decision to implement Plug Power’s integrated cabinet GenSure fuel cell solution and GenFuel hydrogen supply.

The cabinet solution houses both network power and communications equipment and includes GenSure hydrogen fuel cells for backup power. (See Figure 3.) This solution offers up to 87% footprint savings versus a small communications shelter and combustion generator.

Figure 3. New Southern Linc 4G LTE Advanced network sites use integrated power and communications cabinets.

While it is still early in the partnership, Southern Linc expects that this solution will increase the reliability of its network. Southern Linc plans to measure program success by fuel cell uptime and savings in maintenance.[/toggle]

While telecom providers purchase fuel cells because of their myriad benefits, including capital and operational cost savings, reduced physical footprint, and significantly reduced maintenance costs, the importance of IoT-enabled monitoring must not be overlooked. The IIoT enables carriers to stay ahead of hydrogen refueling needs and operational situations that threaten network functionality, thereby ensuring reliability in their operations.

OPTION B: Batteries

For short-term outages, batteries have many positive characteristics. Both VRLA and Lithium Ion batteries have no requirement for an outside fuel source, and their environmental specifications continue to improve with high temperature models no longer requiring costly external cooling. They have few to no air emissions, no vibration and, in cases where HVAC cabinets are not used, no noise. Additionally, installation logistics are quite manageable due to their compact packaging. For a runtime of 4 hours, batteries offer a very small footprint. To bump the runtime up to 24 hours, however, the battery solution — including its footprint — would need to be increased by a factor of 6. Additionally, ongoing battery replacement costs add to operations costs every few years. For operators focused on smaller shelters and cabinets, these factors can negate the positive characteristics of batteries.

In a hybrid solution involving fuel cells and batteries, however, the storage size issue can be mitigated, enabling a "best of both worlds" scenario. The batteries provide backup power for short grid disruptions, saving fuel cell hydrogen for longer outages. The fuel cell provides power for the longer outages, and maintains battery voltage at healthy levels, which increases the overall lifetime of the battery. It’s a symbiotic relationship that allows carriers to decrease both space requirements and emissions.

Battery manufacturers are also beginning to use IIoT to manage the maintenance requirements of batteries. Battery sensors can monitor voltage and temperature, giving a reading on the overall health of the battery, which is helpful for carrier tech teams in managing the backup power operations within their networks.8

OPTION C: Combustion Generators

Combustion generators have legacy on their side. Carriers have used them for decades of storms and power outages, and understand how to install and manage generators. That is not to say that they remain the best solution as carriers focus on smaller sites, IIoT, and sustainability.

For all their experience, generator manufacturers’ best products remain their larger ones. Carriers continue to specify 20kW to 25kW generators at their cell sites, regardless of the actual power requirements, just so they have confidence in a comprehensive product. Still, independent surveys assess these generators’ reliability at only up to 88.4%.9 As site power requirements fall, the expense of a larger generator and the space it occupies compares poorly against other options. Additionally, a brief web survey offered no indication that generators are yet taking advantage of the IIoT.

While generators have decreased their emissions over the years they are still notorious for their pollutants. As a result, states, including California, have set limits to the number of hours a generator can be run in non-emergency situations in order to address the emissions issue.10 The cost of simply tracking runtimes for generators, and fines for not doing so, can be a major drawback.

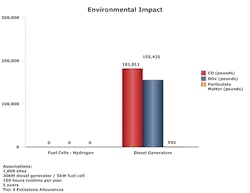

Federal guidelines also limit the amount of emissions allowed by generators.11 But even the most stringent Tier 4 standards allow 5.5 grams of carbon monoxide per kilowatt-hour, 4.7 grams of NOx per kilowatt-hour, and 0.03 grams of particulate matter per kilowatt-hour. When one extrapolates to 1,000 generators providing 150 hours of runtime per year each for 5 years, the environmental impact becomes very clear. (See Figure 2.)

Figure 2. Environmental emissions impact of diesel generator backup power.

Conclusion

Change continues to be a constant for telecommunications professionals. As industry focus hones in on smaller sites with lower power draws, taking advantage of the IIoT for even higher efficiencies, and continued focus on sustainability, the ramifications for choices throughout the network, including backup power, are massive. Moving forward into the 4G/LTE era, total solution packages utilizing alternative energy solutions are quickly becoming a cost-effective, trend-setting reality.

Endnotes

1. John Celentano, "Trends in U.S. Wireless Capital Expenditures," AGL magazine, April 2017, page 32.

2. https://dupress.deloitte.com/dup-us-en/focus/internet-of-things/iot-in-telecom-industry.html

3. Drew Crowder, "Top Drivers for Renewable Energy in Tech and Telecom Sectors," http://www.renewablechoice.com/blog-tech-and-telecom-renewable-energy/, February 2017.

4. http://www.att.com/gen/press-room?pid=23407&cdvn=news&newsarticleid=35457

5. http://www.reuters.com/article/2013/04/30/us-verizon-energy-idUSBRE93T0J020130430

6. https://finance.yahoo.com/news/verizon-boost-solar-40m-almost-120042944.html

7. Survey of Reliability and Availability Information for Power Distribution, Power Generation and HVAC Components for Commercial, Industrial and Utility Installations, Hale/Arno, IEEE Industrial and Commercial Power Systems Technical Conference, 2005.

9. Survey of Reliability and Availability Information for Power Distribution, Power Generation and HVAC Components for Commercial, Industrial and Utility Installations, Hale/Arno, IEEE Industrial and Commercial Power Systems Technical Conference, 2005

10. http://www.dieselserviceandsupply.com/generator_engine_emissions_explained.aspx

11. http://www.dieselnet.com/standards/us/nonroad.php#tier3

Save

Save