Latest from Network Transformation/Edge Compute/IoT/URLLC/Automation/M2M

It’s Time To Get Smarter About Network Optimization

For over 20 years, there have been calls to address The Digital Divide, including a target to achieve universal broadband access to all Americans by 2007. Yet, BroadbandNow reports that in May 2021, 42 million Americans still did not have access to broadband. One barrier is that the definition of broadband relied upon by these initiatives never evolved as quickly as the needs of the market. This, coupled with multi-year timelines for deployment, has exacerbated the problem.

The COVID-19 pandemic dramatically exposed the necessity of high-speed broadband for all to work, learn, and obtain healthcare, propelling the US government into dramatically expanded action. As a result, a record number of funding programs have been launched to expand high-speed broadband. While previous programs were designed and administered by the Federal Communications Commission (FCC), these new programs allocate funds directly to the state, local, territorial, and tribal governments, enabling them to establish priorities and select service provider partners.

The implications of this shift cannot be overstated. How service providers organize their ability to respond strategically with speed and quality not only determines the winners and losers for these new programs, but also the market share, profitability, and valuation, of individual service providers for years to come.

Local Level Decision-Making

Of course, Treasury still has responsibility for instituting the broad funding guidelines. But the decision-making has been pushed to the front lines. In short, The Coronavirus State and Local Recovery Act gives states and local governments significant flexibility in how the monies may be spent, including necessary investments in broadband infrastructure. Plus, the Senate gave overwhelming bipartisan approval on in early September to a $1 trillion infrastructure bill to rebuild the nation’s deteriorating roads and bridges and fund new climate resilience and broadband initiatives, delivering a key component of President Biden’s agenda. Infrastructure and Investment Jobs Act (IIJA) has allotted an additional $68B directly for broadband. The legislation now must pass the House. (This was the case at the time of writing this article.)

With the COVID-19 pandemic lingering on, funding secured, and frustration with the pace of rollout under previous programs, local governments are pressing service providers to help them fast-track high-speed broadband to the underserved and unserved. Service providers are on the hook to identify the underserved with greater accuracy, determine how to build out their network most efficiently, and lay a solid foundation for strong, collaborative, public-private partnerships. All this must be worked quickly against a backdrop where competition and applicable technology are changing rapidly, and the opportunities threaten to overwhelm existing resources.

As a result, it is critical for service providers to understand what competitors are doing within and tangential to their footprint, and to be able to prioritize responses from both an expansion and a defensive posture.

Short Timelines Demand Data

The competition for these programs is intense, and the timelines are short. As we just saw with the NTIA program, 230 applications were received with a total funding request value of $2.5 Billion… all chasing a funding pot of $288 Million. This amplifies the strategic imperative and the strategic dilemma for service providers.

Submissions need to be highly competitive, requiring as little subsidy support as possible. Yet, the service provider needs to have confidence in a threshold ROI to assure the bid is viable if awarded. And they need to be able to focus their efforts on the best opportunities rather than risk spreading themselves too thin.

Consequently, quickly building a robust analytical framework powered by accurate data is crucial to enabling informed strategic decisions and facilitating fact-based conversations with government and community stakeholders.

The framework must include:

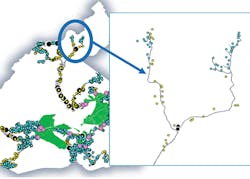

1. A basic foundation of data identifying the locations of the under and unserved relative to service provider footprint, including assessment of upload speeds.

2. Identification of schools, libraries, hospitals, and low-income housing tax credit eligible communities within and tangential to service provider footprint. There may be additional funding and/or assets to be leveraged with these entities that can shore up the business case.

3. Assessment of viable technology options within these communities. For instance, what does clutter and terrain data tell us about the viability of fixed wireless to deliver speeds above 100 Mbps? Are there utility poles suitable for aerial fiber deployment?

4. Incorporating the most appropriate technology options, define efficient, viable project boundaries, and calculate the rough order of magnitude (ROM) cost to serve.

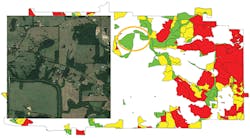

5. In comparison, identify and analyze the competitive landscape, particularly winners of RDOF awards, the assessed value of the award against the ROM, and the likelihood of successfully delivering in the near term.

6. Weighting these attributes and then simply running the math to identify the opportunities with the highest possibility of success.

This type of analysis allows service providers to prioritize and focus efforts on the communities with the most potential to support a solid public-private partnership.

Hard Data For Effective Build-Out Plans

Once the target communities have been identified, the data must be further refined to design the most comprehensive and efficient network plan against community service and coverage targets.

The service provider and community leadership, stewards of the funding, need hard data and reliable insights into the following to make decisions with confidence:

- Other locations and/or Census Blocks that a community may have surveyed and designated as underserved within and tangential to the service provider footprint.

- Where are the underserved or unserved homes with school-going children? Is it possible to use E-Rate or the upcoming Phase 2 Emergency Connectivity Fund (ECF) program to augment the overall community plan?

- What is the average cost for a robust Fiber-to-the-Home network?

- What level of subsidy would be needed to make it a winning proposition for both the local government and the service provider?

- Are there any outlying locations that could drive project costs to be sky high?

- Would fixed wireless to the more remote locations be a viable alternative to achieve the goal for everyone?

- Are there additional households or businesses along the new network path that expand the addressable market and improve the business case?

- Where should the build start to assure the strongest cash flow?

The country has committed massive resources to bring broadband to all and finally address The Digital Divide. With solid expansion plans and market insights, service providers can be prepared to constructively engage with community leaders on pathways to deliver high-performance Internet to their communities at the lowest cost, most efficient manner possible.

The result is a winning proposition for service providers, community leaders, and, most importantly, the community itself.

Resources and Notes

BroadbandNow Estimates Availability for all 50 States; Confirms that More than 42 Million Americans Do Not Have Access to Broadband

https://www.nytimes.com/2021/09/09/us/politics/biden-infrastructure-plan.html

For more information, email [email protected], [email protected], and visit https://www.vcti.io/. Follow us on Twitter: https://twitter.com/velankanicomtec.