Latest from Network Transformation/Edge Compute/IoT/URLLC/Automation/M2M

Top 2017 IoT Trends

Evolving Consumer Technology Market Place Review

The patterns and habits of when, how, and where consumers access information, communicate, and interact with their home are changing. US broadband households own an average of 8.2 connected CE devices, according to Parks Associates.

IoT Trend #1

Voice control is the new user interface to the connected lifestyle.

According to Parks Associates’ Q2 2016 survey, 40% of US smartphone owners use the voice recognition software on their device. Now, the push for voice control use cases is extending beyond the phone to other devices in the home. Amazon Echo uses natural language to handle a number of pre-programmed retrieval tasks (e.g., alarm, lists, weather, music, traffic) and answers questions based on information from Wikipedia. Amazon is aggressively building a large number of partners for its Echo device ecosystem and Alexa voice control solution. Its partnerships with multi-room audio manufacturers such as Sonos could enable a voice-control access point in every room of the house.

IoT Trend #2

The smartphone market has plateaued; mobile carriers experiment to improve subscriber retention.

The US smartphone market hit a saturation point in 2014 with adoption rates holding around 80% and purchase rates declining. US mobile carriers are aggressively iterating data plan offerings to differentiate their services and stay ahead of the competition. T-Mobile reintroduced unlimited data plans and Verizon unveiled a data carryover option.

IoT Trend #3

CE manufacturers are searching for new growth opportunities.

Mobile carriers aren’t the only ones looking for new growth opportunities. Desktop ownership has declined 30% since 2009, down to 61% of broadband households, and it will not recover. Annual desktop purchases continue to decline; just 12% of households bought a desktop in 2015, down from 24% in 2009.

CE manufacturers are looking to compensate for these declining PC sales. One key strategy is to build product ecosystems that have cross-platform functions, as well as cross-marketing opportunities. Apple is a clear leader in this area — consumers are more likely to own multiple CE products from Apple than from any other CE brand. This multiplatform ownership is concentrated in the brand’s mobile products, the iPhone and iPad, but the company is also seeing a bump in its computer adoption. Mac ownership recently topped one-fourth of US broadband households after lingering at 10% for many years prior. As manufacturers move into areas such as smart home and wearables, they will look for ways to tie value propositions across platforms.

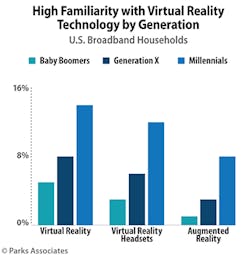

Companies in the entertainment IoT space are watching virtual reality (VR) and augmented reality (AR) to see the impact of these trends on content and consumer engagement. The key to wider adoption is for people to experience these technologies firsthand. Pokémon Go exposed many smartphone users, particularly Millennials, to AR. However, following such rabid interest in the summer of 2016, uncertainty remains as to whether Pokémon Go is a one-off phenomenon or if it truly signals a shift in content distribution that other companies can exploit.

IoT Trend #5

OTT market is growing as consumers continue to try new services.

At the beginning of 2016, nearly two-thirds of US broadband households paid for an OTT video subscription, but this emerging market remained volatile throughout the year. Many OTT subscribers are sampling different services and then canceling. With the exception of Netflix and Amazon Prime, OTT services are experiencing churn rates exceeding 50% of their subscriber base.

The commitment to quality programming through original content, which helped the OTT leaders solidify their positions, has also harkened the return of the living room. When it comes to visual media viewing, the largest screen possible is always preferable, and as OTT viewing takes on a bigger role in a household’s entertainment, the more viewers will use the TV as the OTT delivery device. OTT users watch these services on their TV screens between 17-20 days per month, much more than platforms such as a PC, smartphone, or tablet.

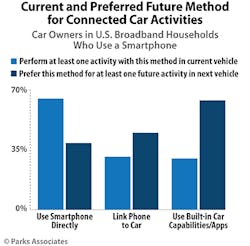

The entry of Apple, Google, and other technology players into the connected car space is forcing many OEMs to open their ecosystems, speed up innovation, and improve the user experience for their in-vehicle infotainment (IVI) services. Open ecosystems could also allay fears of hidden costs among consumers, as they are accustomed to getting free services from companies like Apple and Google. Connected car service providers need to be fully transparent about costs and fees and reassure consumers that the data generated from connected car features will not be used by unauthorized parties or in objectionable ways.

IoT Trend #7

Security channel continues to dominate the smart home market; the industry needs to continue to focus on marketing and building awareness and consumer engagement.

Specific "hero" devices — like the Nest Thermostat or Amazon Echo — have found an enthusiastic user base, but the smart home concept and value proposition remain poorly communicated and demonstrated, with low awareness among mass-market consumers.

The security market continues to be the top channel for smart home products and systems. The value proposition of security makes sense to consumers, and security dealers can properly install the connected devices as well as explain the value of the feature and functions. Recent Parks Associates research found that nearly 25% of US broadband households have a working and active security system, and 65% of these households plan to buy a smart home device within the year.

Creating awareness of smart home products, services, and value in order to generate and leverage the available data from the devices continues to be a key challenge. Parks Associates analysts expect that almost 55 million smart home devices will be sold to US broadband households in 2020. The industry needs to continue to show real-use cases and create products that work together, feature easy set-up and installation, and provide a use case that bring real value to consumers.

IoT Trend #8

Insurers find value in the consumer IoT; data analytics to play critical role.

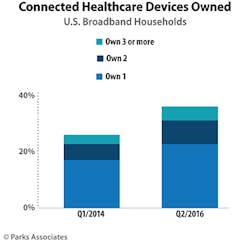

The insurance industry has emerged as a new and significant player in the IoT space. Real-time data collected and transmitted by a growing crop of connected devices provides a new opportunity for insurance companies to deliver value by preventing loss and mitigating damage. Parks Associates research indicates 51% of US broadband households find an IoT device that alerts them to smoke and fire highly appealing.

Insurers in the home, property, auto, and health markets gain valuable insight into customer behaviors through connected device data. They can use this new stream of information to mitigate their risk and lower consumer premiums. Perhaps as importantly, they represent an alternative source of revenues for connected solution providers.

IoT Trend #9

Wearables and smart watches can extend as healthcare/wellness tools.

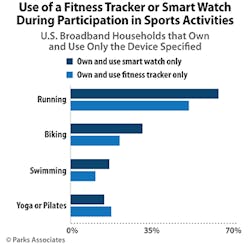

Currently, 11% of US broadband households report owning a smart watch, with Apple dominating with approximately 40% of the market share. Twelve percent (12%) report owning a digital pedometer or fitness/activity tracker with Wi-Fi or Bluetooth connectivity, according to a Parks Associates Q3 2016 consumer survey.

The market for connected wearables benefits from healthcare reforms, which encourage more self-care by consumers and more health monitoring and support from doctors when their patients are outside of the doctor’s office. While fitness trackers are wellness-related by design, smart watches have been marketed as multiuse products. Yet, early adopters report using their smart watches for health tracking (58%) over any other use case tested. Apple’s marketing around its next-generation Watch Series 2 is notably fitness-focused, with new GPS capabilities and swim support.

IoT Trend #10

Utilities still challenged to create consumer engagement despite consumer willingness to save energy.

Consumers are willing to take action to save energy: 84% of US broadband households took some kind of energy-saving action in 2015. Over 60% of US broadband households strongly believe that saving energy and lowering utility bills are important. However, there is low awareness of energy-efficiency programs.

Consumers are interested in easy ways to save energy, and utilities need to find better ways to engage consumers. One strategy to drive engagement is to wed energy with the growing number of smart home devices and create interaction with push notifications and alerts. Another is to expand partnerships between smart device manufacturers and retailers through rebate programs.

Conclusion

Nearly 50% of US broadband households plan to buy a smart home device in the next 12 months, but there is also growing consumer anxiety in the midst of this expansion. In early 2016, almost 50% of US broadband households ranked privacy as their greatest concern about connecting devices to the Internet, and 40% reported having experienced some kind of privacy or security problem with a connected device in the past year. Issues concerning privacy and data security will cross all markets in the IoT, and companies will need to address these concerns in order to maintain the positive growth.

Save

Save

Save

Save

Save

Save

Save